Indian Economics part 1

Indian Economics part 1 consist of a)INDIAN ECONOMY ON EVE OF INDEPENDENCE b)INDIAN ECONOMY TILL 1990c)LIBERALISATIN, PRIVATISATION AND GLOBALISATION which covers the complete syllabus for class 12

INDIAN ECONOMY ON THE EVE OF INDEPENDENCE in Indian Economics part1 ;

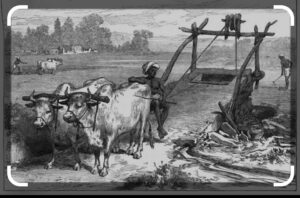

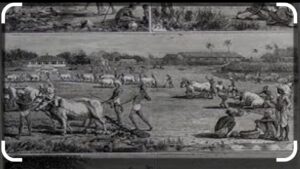

Agriculture was the main source of livelihood , the country ‘s economy was characterized by various manufacturing activities ,

India was well known in the fields of handicrafts, cotton and silk , metals and precious stones works .

There was COLONIAL EXPLOTATION under the British rule was subjected to the exploitation . It implied in all sectors of economy .

i) COLONIAL EXPLOITATION in agriculture sectors through ZAMINDARI SYSTEM on the land revenue . Zamindars were declared as the owners of the land .

They had to pay fixed sum to the government in form of land revenue and free to extract as much as they wished or as much as they could from the tillers of the soil by hook or by crook which was the main reason of physical and mental exploitation over them

ii) COLONIAL EXPLOITATION ON INDUSTRIAL SECTOSR in India implied the predominance of handicrafts . But these were systematically destroyed by allowing tariff free import of machine made goods from Britain .

iii) COLONIAL EXPLOITATION OF INTERNATIONAL TRADE : India’s international trade was exploited through discriminatory tariff policy . Duty free export of Indian raw material was encouraged to enhance access to the Indian Markets by the British industrialists.

AGRICULTURAL SECTOR UNDER BRITISH RULE : Indian agriculture under the British rule showed following characteristics

i) Low level of productivity because of backward technology , irrigation facilities no use of modern fertilizers

ii) High degree of vulnerability with good harvest when it rains good and bad harvest when if rains bad

iii) Dominance of subsistence framing in trillers of the soil took to agriculture merely as source of subsistence never as source of profit Farmers were induced by higher price for producing cash crops so they could be used as a raw material for Britishers

iv ) In land settlement system all the profit accruing out of agricultural sector went to zamindars in the form of Lagaan and they never did anything to improve condition of farming and farmers so it Widen gulf between owners of the soil / Zamindars and tillers always trying to staved their ejection

v) Wastage of revenue income on conspicuous consumption . It was seldom invested for the growth agriculture . Consequently backwardness of agriculture remained the permanent feature.

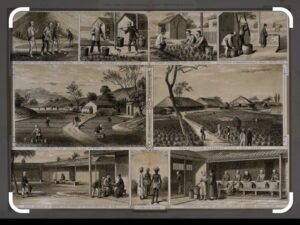

INDUSTRIAL SECTORS UNDER BRTISH ; The condition of industry was very poor Britishers focused in de-industrialization of Handicraft industry They destroyed the industry in very systematic manner to satisfy their two motives

i) to get the raw material from India at cheaper rates for the development of their industry) to sell their finished product in the Indian markets at high price .

By the decline of Handicraft British paid any attention over it as the public sectors remained confined to Railways, Power Station ,Communications , Ports , Departmental undertaking all of them were under their control

There was large amount of discriminatory policy between Britisher and Indian trader . Cheaper industrial goods were allowed tariff free access to the Indian market, Handicraft products from India were the subject to high duty of export so Indian Handicraft lost both Indian and Foreign markets It was completely lop sided

INERNATIONAL TRADE UNDER BRITISHERS : Internatinal trade was hit to India in two ways

i) It was controlled wholly by the British which ended export from India

ii) Composition of trade was made in such a way that India became the exporter of raw material for the British Industry and importer of British finish goods. The Suez Canal served as a direct route for the ships operating between India and Britain .

The export Surplus was used to make payments for expenses incurred by the office setup by the Colonial government in Britain . They also use the earning for the war fought by the British government and import of invisible items

DEMOGRPHIC PROFILE ;

First official census conducted in1881 raveled unevenness in Indian population. In year 1921 it was described the year of great divide and found that During British Rule India had high birthrate, high death rate , high infant mortality rate , low expectancy rate, very low rate of literacy which main cause of the backwardness un India

OCCUPATIONAL STRUCTURE ;

More than 70% of the working population were engaged in agriculture industry which merely gave employment to 9% of the population so large unemployment is the other cause of the backwardness

POSITIVENESS OF BRITISH RULERS :

As the Indian market was very large for the British Goods so they focused on the infrastructure facilities such as transport in fields of roads British did not accomplish much on the construction of roads, the roads that were built primarily served the interest of mobilizing army and shifting of raw material,

Railways most important contribution which affected the Indian economy in two ways

i) made long distance travel for the people easy

ii) development of commercialization of Indian agriculture , development of ports , provision of post and telegraph services were developed to maintain law and order of the country .They also laid the foundation of strong and efficient administration

SOME IMPOTANT FACTS ;

i) Battle of Plassey 1757 ii) Introduction of Zamindari system by Lord Cornwallis in 1793 iii) First postal stamp 1852 iv) Introduction of railway in India 1850 v) First Railway bridge from Bombay to Thane 1853 vi) opening of Suez Canal 1869 vii) First official census 1881 viii) Setting up of Tata Iron and Steel Company 1907 ix) year of great divide 19 21 x) Airline by Tata 1932

INDIAN ECONOMY (1950- 1990) in Indian Economics Part 1

TYPES OF ECONOMY in Indian Economics part 1;

There are three types of economic system found in the economic world

i) CAPITALIST ECONOMY It is the one in which the means of production are owned and operated by the private sectors

ii) SOCIALIST ECONOMY is the one in which the means of production arre owned and operated as well as controlled by the Government of the country

iii) MIXED ECONOMY is the one in which the public as well as private sector are allotted their respective position for solving the central problem of the economy

INDIA is a democratic country and adopted the policy of MIXED ECONOMY with a view that it would be socialistic with strong public sectors and the private sectors would also be made power to contribute in the development of India

ECONOMIC PLANNING ;

For the development of Indian Economy it was very important for the Government to plan for the Economy .

Economic Planning can be defined as making the important major economic decisions on basis by comprehensive survey of the whole economy the determinate authority

PLAN is said to be a documents showing detailed scheme program and strategy, work out in advance for fulfilling the objective of te country’s economy.

THE GOALS OF 5 YEARS was set up was known to be FIVE YEAR PLAN with the aim to remove all economic backwardness of the country and to make India the developed economy.

Each of the Five Year Plan had the basic goal for the development of India these goals were a) Growth b) Modernisation c) Sef reliance d) Equity

GROWTH means to increase the productivity capacity of the country so that we may produce maximum goods and services within our country.

It implies large stock productive capital or large size of supporting services or increase in efficiency of productive capital and services so that there is steady increase in Gross Domestic Product (GDP) which is good indicator of economic growth.

In some countries like India growth in agriculture contributes more on GDP but in some countries the service sector plays the important role in contribution in GDP.

MODERNISATION is needed to raise the standard of living of people which includes adoption of modern technology this will increase the production of goods and services by the means of new technology .

The modernisation also changes the social outlook of the people such as gender empowerment , providing equal rights to women etc

SELF RELIANCE It directly means overcoming the needs of external assistance , the five year plan majorly focus on use of own resources so that there may be less dependence of foreign goods and services

It was important for main reasons less drain out of wealth , less dependence on foreign goods and very less interference of outsiders of our country

EQUITY aims to ensure that every Indian should be able to meet his /her basic needs ie food, house, education ,health and inequality of wealth should be reduced.

This is aimed to increase the standard of living of the people of the country and this also promote the social justice.

AGRICULTURE SECTOR has contributed large share of workforce so it was very important for agriculture development being focused in Five Year Plan .The Two main measures were taken to develop agriculture first was the land reforms and green revolution.

LAND REFORMS : It refers to change in the ownership of landholding . Land reforms were needed to achieve the objective of equity in agriculture .

Abolition of intermediaries that Indian Government took various steps to abolish intermediaries and to make farmers , owner lands .

The ownership rights given to the tenants gave them the incentive to increase output and this contributed to the agriculture .

Land ceiling was another step in which fixing the specified the limit of land which can be owned by the individual.

Beyond the specified limit all the land belonging to the person would be taken over by the Government will allocate to landless farmers which promote the equity in agriculture

GREEN REVOLUTION

It refers to large increase in the production of food grains due to use of high yielding seeds variety HYV seeds raised the agriculture production per acre in many fold times . HYV seeds need reliable irrigation facilities and financial resources to purchase fertilizers and pesticides .

GREEN REVOLUTION is responsible for attaining marketable surplus , it is beneficial to low income groups also create the buffer stock .

There are some bad effects of green revolution such as there is a great risk of pest attack because HYV seeds were more prone to pest attack and there is a risk in income inequalities because there are costly inputs required under the Green Revolution will increase the disparities between small and big farmers.

The Government of India had played important role to overcome the bad effects by providing the loans at low interest rate to small farmers so that they could buy required inputs so the green revolution benefited both rich and small farmers .

Economists who were in Favour of subsidies think that farming in India continue to be risky business, majority of the farmers are very poor and they cannot buy the costly modern inputs of farming so subsidies must begiven if there will be no subsidies it will give birth to greater inequalities

Those Economists who were against subsidies because it is beneficial to the fertilizer industry and prosperous farmers and not the target group and huge burden to Government treasure.

CRITICAL APPRAISAL OF AGRICULTURE : Green Revolution and Land Reforms highly supported the farmers which increase the production many fold times , India became self sufficient in food production ,and abolition of Zamindars gave great relief to Farmers from their atrocities though the proportion of contribution by agriculture declined but not the population depending on it

INDUSTRIAL DEVELOPMENT Five Year Plans focused a lot on the industrial development. The Cotton textile and Jute Industries were mostly developed in India but there was a strong need to expand the industrial base with verity of industries

ROLE OF PUBLIC SECTOR ; There was a great need for leading of public sector because of shortage of capital with private sectors , entrepreneurs did not have the capital to undertake investment in the industrial ventures, lack of incentive for private sectors because the Indian market was not big enough to encourage private industrialist to undertake the major projects and finally they fulfill the objective of social welfare which could only be achieved through direct participation of state in the process of Industrialisation

INDUSTRIAL POLICY It is a complete package of policy measures which covers various issues with different industrial enterprises of the country .

According to Industrial Policy Resolution 1956 the industries were divided into three schedule . In Schedule A is comprised of the industries which would exclusively be own by the state, In Schedule B there were 12 industries were placed that would be progressively state owned and in last Schedule C consist of the remaining industries under private sectors.

INDUSTRIAL LICENCE was the written permission from the Government to the industrial unit to manufacture goods . The Industrial Development Regulation Act 1951 empowered the government to issue the lience for setting up new industries , expansion of existing industries and diversification the product.

No new industry was not allowed unless the licence was issued to them from the government. It was easier to obtain the licience if the industrial unit was establish in the economically backward aera.

Licence was needed even if an existing industry wants to expand output or diversify its products

SMALL SCALE INDUSTRIES (SSI) SSI is defined as industry of more labour intensive so they generate more employment and there is need for the protection from big firms

SSI cannot compete with big industry firms so Government reserved production of number of products for them and they were also give subsidies in much field in the process of production as less cost of raw material , subsidies in various taxes etc

FOREIGN TRADE : Foreign trade in India includes all imports and Exports to and from India . India has followed the strategy of replacing many imports by domestic production . Import substitution policy is the replacement of imports by domestic country .

This policy can serve to definite objective such as saving of precious foreign exchange and achieving the Selfreliance .Protection through Tariffs which is a kind of taxes levied on import goods which make goods expensive to discourage the in the country and Quotas is non tariff barriers imposed on the quantity of import and export .

All this is done to enable them to compete against the goods produced by more developed economy and to prevent the drain out the foreign exchange reserve on the import of luxury goods

CRITICAL APPRAISAL OF INDUSTRIAL DEVELOPMENT : The proportion of GDP increased from 11.8% to 24.6% .

The industrial sector became well diversified by 1990 largely due to Public Sectors.

The promotion of small scale industries gave opportunities to people with small capital to get into the business. The protection from the foreign competition through import substition enabled development of home made goods industries .

Licensing Policy helped the Government to monitor and control the industrial production. Public Sectors made a remarkable contribution by creating industrial base development and infrastructure and also promoted industrial development of backward aera

IMPORTANT FACTS : i) First Industial policy resolution in 1948 I

ii) Setting up of Planning Commission under the chairman ship of Prime Minister in1950

iii) First five year plan 1951

iv) Industrial Development and Regulation Act 1951

v) Karve committee/ Village and small industries committee constituted

vi) Duration of Five year plan 1 st April – 31st March 1956

vii) second industrial policy Resolution 30th April 1956

viii) First phase of Green Revolution 1966

ix ) New Economic Policy 1991

x) Planning Commission relaced by NITI Aayog 2015

LIBERLISATION , PRIVITISATION GLOBALISATION ;in Indian Economics part 1:

There was the poor performance of public sectors, large amount of deficit balance of payment ,high inflationary pressure , very low foreign exchange was left with huge burden of debts above all was the inefficient management were the main reason to make economic reforms in India .

INDIAN GOVERNMENT approached to World Bank and IMF and received the loan of$7 billion in lieu from India to Liberalise and open up the Economy by

i) removing restriction on Private sectors

ii) Reducing the role of government in many aeras

iii) Removing the trade restrictions .

The New Economic Policy was announced to create competitive atmosphere in the economy and removal of barriers to entry and growth firms .NEP was adopted with various measure

i) Stabilisation Measure which focus on correcting the weakness of BOP by maintaing the sufficient amount of foreign exchange reserve and secondly by controlling the inflation by keeping price rise under control

ii) India started improving efficiency of the economy and also increase the international competitiveness as it’s structural reforms .

The main policy of NEP were liberlisation, Privitisation and Globalisation

LIBERALISATION in Indian Economics which means removal of entry and growth restrictions on the private sectors with the aim to unlock the economic potential of the country with good competition into the economy by making reforms in Industry Sectors , Financial Sectors, Tax, Foreign Exchange , Trade Investment Policy

IN THE INDUSTRIAL REFORMS in Indian Economics various steps were taken as i) Reduction in Industrial Licensing NEP abolished industrial License system from all the projects except some short list industries .

They also decrease the role of Public Sectors . The number of industries exclusively reserved for Public Sectors have been reduced in quantity. Many goods produced by small industry were de reserved .

The Monopolies and Restrictive Trade Practices Act (MRTP) was removed in which large companies had to take permission for the expansion / merger now they can produce as much as they can and may merge per their requirements.

FINANCIAL REFORMS In Indian Economics includes various changes in the sectors

i) The Role of RBI was reduced from Regulator to Facilitator of financial sectors , This also lead to establishment of Private Banks

.ii)The limit of foreign investment in banks raised to around to 51%

iii) Banks were given the complete freedom to open the new branches without any approval from RBI

TAX REFORMS in Indian Economics

The Government of India made lots of reform in ta policy and public expenditure policy which is also called FISCAL POLICY

,There are two kinds of taxes Direct and Indirect Taxes the major reforms were

i) Rationalisation in Direct Taxes

ii) Simplification in filling the taxes

iii) Many reforms were made in the indirect taxation

FOREIGN EXCHANGE REFORMS : This includes the devaluation of rupee to overcome balance of payment and the Government allowed rupee value to be free from it’s control and made it market determination of exchange rate

TRADE AND INVESTMENT REFORMS : The important trade and investment reforms were

i) Indian Government removed the quantitative restrictions on export and import ,

ii) They removed the Export Duties and large reduction was made on import duties

iii) Great relaxation was made in import licensing system

PRIVATISATION in Indian Economics is shedding of he ownership/management of the government owned enterprises .Privatisation can be done in two ways

i) Disinvestment

ii) By Transfer of ownership and management to some Private sectors

GLOBALISATION in Indian Economics is integrating the national economy with the world economy through the removal of barriers on the international trade and capital investment .

It resulted in greater access to global market with advanced technology and better future prospects for large industries of developing countries but it give benefits more to developed economy though Globalization comprises the welfare and identity of people belonging to poor countries but market driven globalization creates economic disparities among the nation and people

OUTSOURCING in Indian Economics is the hiring business services from external sources , mostly from the other countries which were previously provided internally of from within the country . India has become a favourable destination of out sourcing because of low wages and more availability of skill manpower

WORLD TRADE ORGANISATION was formed in 1995 as the successor of GATT. As an important member of WTO , India has been in forefront of framing fair global rules and regulations and advocating the interests of developing world.

India should not be the member of WTO because major volume of international trade occurs among the developed countries and developing countries are being c to open up their market cheated as they are forced to open market for developed nations but not allowed to access to market of developed countries

SOME IMPORTANT FACTS OF MARKET as

i) BILATERAL TRADE means trade between the two countries

ii) MULTILATERAL TRADE is the trade among more than two countries

iii) TARIFF BARRIERS are the barriers imposed on the imports to make than relatively costly to protect the domestic production

iv ) NON TARRIF BARRIERS which are imposed on the amount of imports and exports

Some of the Economists are in Favour of Economic reforms because it increase in the rate of Economic Growth , Inflow of foreign investment ,that will rise the foreign exchange reserves , rise in export and control the inflation also will increase the role of private sectors

Some of the Economics highly criticized the economic reforms because it created more and more unemployment , It had purely neglected the Agriculture.

The Public investment has been reduced along with the reduction in fertilizer subsidy which adversely affected the small and marginal farmers, reduction in import duties of food product due liberation and shift to cash crops of the farmers led to rise in the prices of food grains

Industrial growth recorded the slow down because of cheaper imports replaced the demand for domestic goods and the domestic manufacturer are facing the stiff competition they lack with intrastromal facilities and non tariff barriers of developed countries.

The dis- investment policy of the Government was not successful because assets of PSU were undervalued and sold to private sectors at very low price and the proceeds received were used to compensate shortage of government revenues .

NEP had very ineffective tax policy ,The reduction in tax decrease the scope of increase the revenue by custom duties and tax incentives to attract the foreign investment which badly affected the revenue of the country .

It also encouraged the consumerism by encouraging the production of consumer luxuries goods and superior consumption . There was unbalanced growth in some selected aeras such as service sectors but very less in production

APRASIAL OF LPG :

There has been increase in the growth . India rate after LPG the growth rate of GDP has become as high as 8% mainly in service sector , Due to the Policies of LPG IT industry in India has obtained the Global recognition .

There had been large increase in foreign exchange reserve. India became large exporter of auto parts, engineering goods ,IT software , Textiles etc . Inflation was brought under control from 16.67% to 2.9% in (2017-18).Fiscal deficit reduce to 3.5% of GDP and Deficit in Balance of Payment has reduced

DEMONTISATION :

It is a situation where the central bank of the country withdraw the old currency notes of certain denomination as the mode of the payment.

On 8thNovember 2016 the government of India announced the denomination of Rs 500 and Rs 1000 banknotes of the Mahatma Gandhi series and issue of new Rs500 and Rs2000 banknotes of Mahatma Gandhi series in the exchange for the old notes.

In India the government had demontised banknotes on two prior occasions once in 1946 again in1978 to control the black money

THE AIM OF DEMONTISATION was to curb the corruption and illicit activities, to curtail the circulation of counterfeit currency ,tax evasion may be control, it channelise saving through formal banking system and shifted cash economy to digital economy

DEMONTISATION slow down in the growth process due to reduction in both demand and supply . It decline in the stock of black money and increase in bank deposits this decline in the indirect and corporate taxes to the extent of slow down in the growth process

GOODS AND SERVICE TAX (GST) It is an indirect tax levied on the supply of goods and services . GST ACT was passed in the Parliament on 24 March 2017 and came into effect on 1st July of same year.

Before GST many central and state taxes were levied in India but after GST all the indirect taxes were summed up under GST with the Principle of one nation one tax.

GST is a comprehensive tax as various indirect taxes have been merged in it , IT is a multistage tax as it is proposed to be levied at all stages.

It is value added tax because it is levied on the value addition at each stage on the supply chain . It is a destination based tax as the tax would accrue to the tax authority which have jurisdiction over the place of consumption.

The custom duty, Taxes on petroleum products , Taxes on Alcoholic drinks and taxes levied by local bodies were not included in GST

The taxes that have been summed up under GST are Central level Taxes such as excise duty service tax and central sales tax and state level tax such as entertainment taxes .

There are three types of GST

i) CENTRAL GST (CGST) Itis levied and collected by the collected by the central government on any transaction of goods and services that takes place within the state

ii) STATE GST (SGST) Itis the tax levied and collected by the state government on every intra-state transaction of goods and services

iii) UNION TERRITORY GST (UGST) It is applicable on the goods and services transactions that take place in any of the five union territory of India

iv ) INTEGRATED GST (IGST) Itis applicable on the interstate transaction of goods and services .

MAIN BENEFIT OF GST ;

It has fostered economic growth ,Introduction of a single tax has led to ease of doing business for enterprises .It help in attracting foreign investment and it has insured better tax compliance and reduction in the cost of goods

THE MAIN OBJECTIVE were to eliminate multiple taxes , improve tax compliances ,boost the economic growth , it will increase the ease of doing business , it will reduce the overall burden of taxes ,It subsumes all indirect taxes at Centre and state level , It also eliminate the cascading effect of indirect taxes on single transactions and it promote consumption base tax than manufacturing

IMPORTANT FACTS

I) Establishment of GATT with 23 members countries as global trade organisation

ii)NEW ECONOMIC REFORM POLICY in July 1991

iii) NEW INDUSTRIAL POLICY in 24 July 1991

iv) WTO in 1995 v) Removal of quantitative restriction on imports of manufacturing consumer goods and agricultural products in April 2001

vii) Make in India i September 2014

viii) Demontisation in India in * November 2016

ix ) GST ACT passed in Parliament in29 March 2017 and came into effect 1 July 2017.

CONCLUSION : INDIAN ECONONMICS PART 1

we assure that after reading the Blog Indian Economics part 1 the readers will get clear and basic idea about the Indian economy at the eve of independence, and the change in the Indian Economics during 1950-1990 and many economic reforms in the 21 century in Indian Economics .

Follows us on :Facebook

Read More: Indian Economics part 2