Indian Economics part 3

The Indian Economics part 3 consist of wide chapters of class 12 RUEAL DEVELOPMENT , HUMAN CAPITAL FORMATION , COMPARATIVE DEVELOPMENT OF INDIA/ PAKISTAN/ CHINA which covers complete syllabus of class 12

Rural Development in Indian Economics part 3

Rural development means an action plan for the social and economic benefit of the rural areas.

Objectives of rural development:

1. Increasing productivity in agricultural sector.

2. creating means of livelihood in rural sector.

3. developing education and health facilities in the rural areas.

The key issues of action plan for rural development are

(i)A better system of rural credit.

(ii) A system of marketing that ensures minimum price to the farmer for produce.

(iii) Diversification of crops that reduce risks of production and make the farming commercialisation of farming.

(iv) Diversification of production activity with a view to find alternative means of sustainable living other than crop-cultivation.

(v) Promotion of organic farming with a view to make crop cultivation environmental friendly as well as a sustainable process over a long period of time.

(vi) Honest system of land reforms.

(vii) Development of human resource like health, addressing both sanitation and public health.

(viii)Development of infrastructure of the rural aera

(ix)Human capital formation by creating education , health and other facilities

(x)Development of productive resources

(xi)Poverty alleviation and making land reforms

Types of Rural Credit in Indian Economics

Rural credit means credit for the farming families. Credit is the life line of farming activity credit needs of the typical Indian farmer may broadly be classified as under

Short Term Credit It needs relates basically to the purchase of inputs like seeds fertilisers etc short term borrowings generally stretches over a period of 6 to 12 months.

Medium Term Credit Medium term loans are required for purchasing machinery constructing fences and digging wells. Such loans are generally stretch over a period of 12 months to 5 years.

Long Term Credit Long term credit is meant for the purchase of additional land. The period of such loan ranges between 5 to 20 years.

Sources of Rural Credit in Indian Economics

i)Non-institutional sources ii)Institutional sources a)Co-operative credit societies b)state Bank of India c)Regional Rural Bank d)National Bank for Agriculture and Rural Development (NABARD)

1)Non-institutional sources are money lenders, traders and commission agents, landlord, relatives and friends.

2). Institutional sources are as follow:

(i) Co-operative credit societies.

(ii) Commercial Banks

(iii) Regional Rural Banks

(iv) NABARD (National Bank for Agriculture and Rural Development.) (established in 1982)

(v) Self Help Groups (SHGs)

Most formers in India are small and marginal land holders who practice subsistence farming. They have no surplus for further production

Borrowings of a farmer can before the following purpose

Productive Borrowings These borrowings include loans to buy seeds, fertilisers and agricultural equipment and implements.

Un-productive Borrowings These borrowings include loans for social purposes such as marriage and festive occasions .

Credit in the rural sector is available from two sources

1. Non-institutional Sources of Rural Credit

The major non-institutional sources of rural credit are moneylenders, friends, relatives, landlords, shopkeepers and commission agents.

Moneylenders provided about 93.6% of total financial requirement rural areas in 1951-52 and presently it is 30%.

The short-term credit needs of the formers are met from commission agents, friends and relatives which supply roughly 50% of total rural borrowings, Non-institutional sources of credit are not encouraged by government because of the following reasons

They charge high rate of interest.

They acquire land on failure to pay interest and loan.

They manipulate accounts. Institutional Sources of Rural Credit In regard to rural credit, major change occurred after 1969, when India adopted social banking and multi agency approach to adequately meet the needs of rural credit.

Different institutions were formed to provide the rural credit.

The major institutional sources of rural credit are as follows

(i) National Bank for Agriculture and Rural Development (NABARD)

It was set up in 1982 as an apex body to coordinate the activities of all institutions involved in the rural financing system.

It has an authorised share capital of Rs. 500 crore. The RBI has contributed half of the share capital while the other half has been contributed by Government of India.

The main functions of NABARD are i)To grant long-term loans to the State Government for subscribing to the share capital of cooperative societies’)

To take the responsibility of inspecting cooperative banks, Regional Rural Banks (RRBs) and primary cooperative societies’)To promote research in agriculture and rural development.

To serve as a refinancing agency for the institutions providing finance to rural and agricultural development)To help tenant farmers and small farmers to consolidate their land holdings.

The national agricultural credit fund been transferred from RBI to NABARD to form a part of its national rural credit fund.

(ii) Self Help Groups (SHGs) Formal credit system has proven inadequate. It has also not been fully integrated into the overall rural, social and community development.

Due to the demand of some kind of collateral, vast proportion of poor rural households were automatically out of the credit networks. Self Help Groups emerged to fill this gap, created by formal credit system

Self Help Groups (SHGs) promote thrift in small proportions by a minimum contribution from each member.

By March end 2003, more than Rs. 7 lakh SHGs had reportedly been credit linked. Such credit provisions are generally referred to as micro-credit programmes.

SHGs have helped in the empowerment of women. However, borrowings from SHGs are mainly confined to consumption purposes.

(iii) Regional Rural Banks (RRBs) As a supplement to commercial banks, the regional rural banks have also been opened. These have been set up under the Regional Rural Banks Act-of 1976.

Their banking services are meant for small and marginal formers and artisans, etc. They cater exclusively to the needs of weaker section. Nearly 90% of the loan of RRBs were provided to the weaker section.

Kisan Credit Card Scheme

Kisan Credit Card scheme (KCCs) was introduced by the government in 1998-99. It facilitates access to credit from commercial banks and regional rural banks.

Under the scheme, the eligible farmers are provided with a kisan card and pass book from the relevent bank. The farmers can make withdrawls and repayments of cash within the credit limit as – specified in the Kisan Credit Card (KCC).

(iv) Commercial Banks They were inducted into the field of agricultural credit under the Banking Reforms Act, 1972.

The share of commercial banks in the supply of agricultural credit has considerably improved. It was 46.9% during the year 2006-07.

Commercial banks disburse agricultural credit for the purchase of inputs, cattle, tractors, dairy farming, installation of tube-wells, etc.

(v) Cooperative Credit Societies The cooperative credit societies are actively engaged in addressing credit needs of the farmers, besides offering a host of related services.

Notably these societies provide guidance in diverse agricultural operations with a view to raise crop productivity. Currency, cooperatives account for 16-17% of rural credit flow.

The main function of cooperative credit society is to provide timely and increased flow of credit to the farmers.

Latest Status of Agricultural Credit in Indian Economics

The following points reveal the latest status of agricultural credit)

The credit flow in this sector in 2011-12 is placed at Rs. 475000 crore

.ii)The agricultural debt waiver and debt relief scheme was announced in the union budget 2008-09.

iii)Farmers have been receiving crop loans upto a principal amount of Rs.3 lakh at an effective rate of 4% per annum

.iv)To provide adequate and timely credit support to the formers, the Kisan Credit Card (KCC) scheme was introduced in February, 1999. About 10.78 crore KCCs had been issued upto October 2011.

vi)Government is implementing a revival package for short-term rural cooperative credit structure involving financial outlay of Rs. 13596 crore.

Rural Banking : A Critical Appraisal

After the nationalisation of commercial banks in 1969, the rapid expansion of the banking system in rural areas has been witnessed. Rural banking has raised the level of rural farm and non-farm output, income and employment especially after the green revolution.

Advantages of Rural Banking in Indian Economics

Raising farm and non-farm output by providing services and credit facilities to farmers.

Generating credit for self employment schemes in rural areas.Achieving food security which is clear from the abundant buffer stocks of grains.

Limitations of Rural BankingIt is suggestible that more and more regional rural banks should be set up to need the credit need of the rural and backward areas of India Small and marginal formers receive only a very small portion of the institutional credit. Rural banking is suffering from the problems of large amount of over dues and default rate. The sources of institutional finance are inadequate to meet the requirements of agricultural credit. There exist regional inequalities in the distribution of institutional credit.

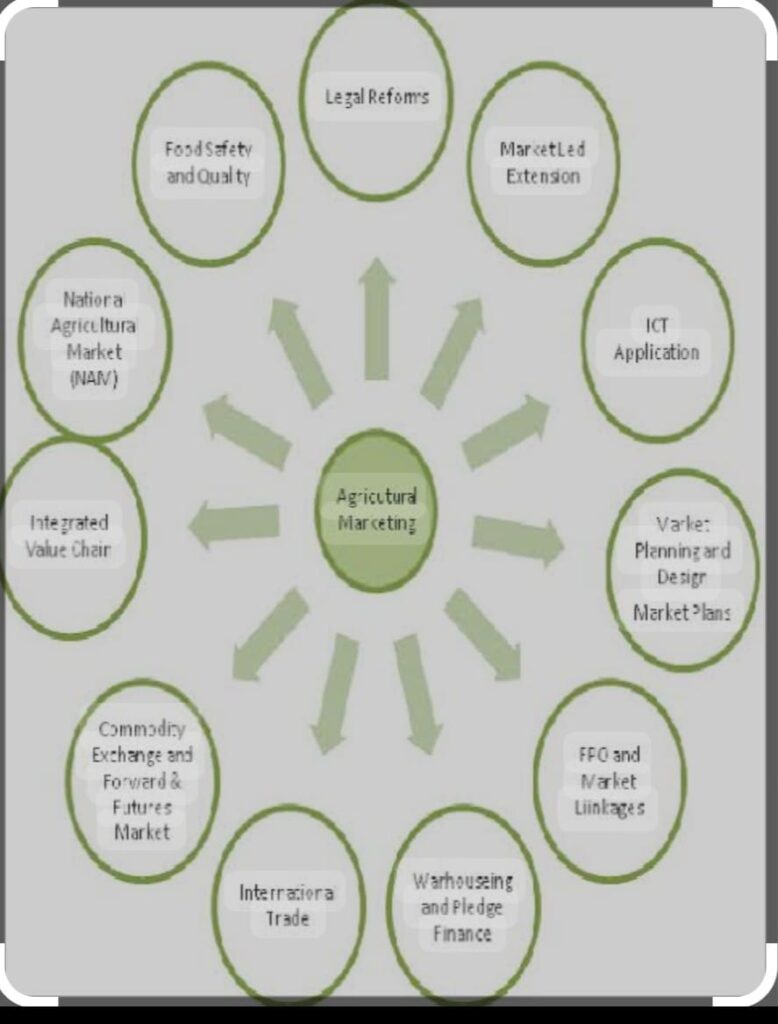

Agriculture Marketing in Indian Economics part 3

It includes all those activities or processes which help a former getting maximum price for his produce among others, these processes include grading packaging and storage.Measures Initiated by the Government to Improve Market System

i)Regulated markets)

ii)Co-operative agricultural marketing societies

iii)Provision of warehousing facilities Subsidised transport

iv)Dissemination of information

v)MSP policy

Diversification is an emerging challenge in the context of rural development. It has two aspects. Diversification of Crop Production It implies production of diverse variety of crops rather than one specialised crop.

It means a shift form single-cropping system to multi-cropping system. Diversification of Production Activity/Employment It implies a shift from crop farming to other areas of production activity employment.

Non-Farm Areas of Production Activity/Employment for the Rural Population

Animal Husbandry It is the most important area of employment in India different from crop farming. It is also called live stock farming, poultry, cattle etc.

Fisheries The fishing community in India depends almost equally on inland sources and marine sources of fishing. Inland sources include rivers, lakes, ponds and streams etc.

Horticulture Horticultural crops include fruits, vegetables and flowers besides several other. Over time, there has been a substantial increase in area under horticulture.

Cottage and Household Industry This industry has been dominated by such activities as spinning, weaving, dyeing and bleaching.

Organic Farming and Sustainable Development in Indian Economics part 3

Organic farming is a system of farming that relies upon the use of organic inputs for cultivation.

Organic inputs basically include animal manures and composts.

Benefits of organic farming are as follows

i)Discards the use of non-renewable resources

ii)Environment friendly

iii) Sustains soil fertility Healthier and tastier food

iv)In expensive technology for the small and marginal farmers

Golden Revolution

The rapid growth in the production of diverse horticultural crops such as fruits, vegetables, tuber crops and plantation crops is known as Golden Revolution.

Agriculture is the major source of livelihood in the rural sector.

Mahatma Gandhi once said that “real progress of India did not mean only the industrial growth but also the development of villages because two-third of India’s population depends on agriculture”.

One-third of rural Indians still live in poverty. This is the reason, why there is need to develop rural India.

Rural Development and Rural credit in Indian Economics

Rural development is a comprehensive term which essentially focuses on action for the development of areas that are lagging behind in the overall development of the village economy.

It is a process whereby the standard of living of rural people, especially poor people, rises continuously.

The basic objectives of rural development are Increasing the productivity of the agricultural sector, so that the income of the formers increase.

Generating alternative means of livelihood in the rural areas, so that dependency on agriculture sector is reduced.

Promoting education and health facilities in the rural areas, so that human development is also achieved.

Key Areas in Rural Development

Some of the areas which are challenging and need fresh initiatives for development in rural India are as follows

i)Development of the productive resources of each locality

ii)Development of human resources including literacy (more specifically female literacy) education and skill development

.iii)Development of human resources like health, addressing both sanitation and public health.

iv) implementation of land reforms in proper manner so the small farmers and marginal farmers get benefit

v)Infrastructure development like electricity, irrigation, credit, marketing, transport facilities including construction of village roads and feeder roads to nearby highways, facilities for agriculture research and extension and information dissemination.

vi)Special measures for alleviation of poverty and bringing about significant improvement in the living conditions of the weaker sections of the populations emphasizing access to productive employment opportunities.

The share of agriculture sector’s contribution to GDP was on a decline, the population dependent on this sector did not show any significant change.

Further, after the initiation of reforms, the growth rate of agriculture sector decelerated to 2.3% per annum during the 1990s, which was lower than the earlier yearsAchieving food security which is clear from the abundant buffer stocks of grains.

Limitations of Rural Banking

Small and marginal formers receive only a very small portion of the institutional credit.Rural banking is suffering from the problems of large amount of over dues and default rate.

The sources of institutional finance are inadequate to meet the requirements of agricultural credit. There exist regional inequalities in the distribution of institutional credit.

It is suggestible that more and more regional rural banks should be set up to need the credit need of the rural and backward areas of India.

Agricultural Marketing, Diversification of Agricultural Activities and Organic Farming in Indian Economics Part 3

Agricultural Marketing Agricultural marketing is the process that involves functions of assembling, storage, processing, packaging, transportation, grading and distribution of agricultural commodities throughout the country.

In other words, agricultural marketing covers the services involved in moving an agricultural product from the farm to the consumer.

Need of Agriculture Marketing

Need of agriculture marketing originates due to the problems faced by farmers.

Different types of problems faced by the farmers are

a)Farmers while selling their produce to traders suffered from faulty weighing and manipulation of accounts.

b)Due to lack of knowledge about the prices prevailing in the markets, farmers are often forced to sell their produce at low prices.

c)Farmers did not have proper storage facilities to keep back their produce for selling them at better price.

Approximately 10% of goods produced in farms is wasted due to lack of storage.

Distress Sale Lack of agricultural marketing infrastructure often forces the farmers to sell their produce at low prices for fear of spoilage or to pay off an imminent debt. This is termed as distress sale.

Farmers tend to suffer highly on account of these sales, because they not only get a low price for their produce, but are also cheated by use of false weights and are charged a high commission.

Measures by Government to Improve Agriculture Marketing

Four measures which were initiated to improve the agriculture marketing aspect are discussed below

1. Regulation of Markets The first measure to improve agriculture marketing aspect is regulation of markets to create orderly and transparent marketing conditions.

Regulated markets have been established where sale and purchase of the produce is monitored by the Market Committee consisting of representatives of government, farmers and the traders.

Market committee ensure that the formers get appropriate price of their produce. By and large, this policy benefited farmers as well as consumers. However there is still need to develop about 27000 rural periodic markets as regulated market places to realize the full potential of rural markets.

2. Improvement in Physical Infrastructure It is the second measure to improve the agriculture marketing aspect. The current infrastructure facilities like; roads, railways, warehouses, godowns, cold storages and processing units etc are inadequate to meet the growing demand. Through this measure government ensures the improvement in physical infrastructure.

3. Cooperative Marketing It is the third measure taken by government in realising the fair prices for farmers products.

As members of these societies, formers find themselves better bargainers in the market and get better prices of their produce through collective sale. The success of milk cooperatives in Gujarat and some other parts of the country are the brilliant examples of cooperative marketing.

Different problems faced by cooperative during the recent past are

- Inadequate coverage of former members.

- Lack of appropriate link between marketing and processing cooperatives.

- Inefficient financial management.

Supporting Policies

It is the fourth measure taken by government to improve agriculture marketing system. Different supportive policies applied in this regard are

Minimum Support Price (MSP) is an important step to improve agriculture market system. MSP is an assurance to the farmers that a minimum price will be fixed by the government to formers’ produce, no purchasing can be done below this price, however farmers can sell their produce in open market above MSP. This policy assured a minimum income to the farmers.

Maintenance of Buffer Stocks of Wheat and Rice Purchases from the farmers are kept by Food Corporation of India as buffer stocks.

Distribution of Foodgrains and Sugars Through Stocks purchased by government at MSP are used primarily for Public Distribution System (PDS). Distribution of foodgrains and other necessary items like kerosene oil at subsidised price to the poor takes place through fair price shops.

Emerging Alternative Marketing Channels In India, alternative marketing channels are emerging. Through these channels, farmers directly sell their products to the consumers. This system increases farmers’ share in the prices paid by the consumers.

Important examples of such channels are

i)Apni mandi (Punjab, Haryana and Rajasthan).

ii)Hadaspar mandi (Pune); Rythu Bazars (Vegetables and fruit market in Andhra Pradesh)

.iii)Uzhavar sandies (Farmers’ Markets in Tamil Nadu).Several national and international fast food chains and hotels are also entering into contracts with the farmers to supply them farm products (fresh vegetables and fruits) of the desired quality.

Diversification into Productive Activities

Diversification means a major proportion of the increasing labour force in the agricultural sector needs to find alternate employment opportunities in other non-farm sectors. Diversification is an emerging challenge in the context of rural development. It has two aspects

i)Diversification of crop production

ii)Diversification of productive activity

Diversification of Crops

This implies a shift from single cropping system to multi-cropping system. In India, where subsistence farming is still dominant, it may also mean a shift from subsistence farming to commercial farming.

Significance of Diversification of Crops Diversification of crops is improtant because it willi)Minimise the risk due to failure of monsoon .ii) Reduc the market risk arising due to price fluctuations.

Need of Diversification into Productive Activities

Agriculture sector is a seasonal based activity, most of agriculture employment activities are concentrated in Kharif season.

In Rabi season, in the areas where irrigation facilities are inadequate, it becomes difficult to find gainful employment.

So, there is a need to focus on allied activities, non farm employment and other emerging alternatives of livelihood.

Also agriculture sector is already overcrowded, a major proportion of the increasing labour force needs to find alternate employment opportunities in other non-farm sectors.

Some non-farm activities are discussed below

1. Animal Husbandry

In India, the forming community uses the mixed crop-live stock forming system. Cattle, goats, fowl are the widely domesticated species.

Livestock production provides increased stability in income, food security, transport, fuel and nutrition for the family without disrupting other food producing activities. livestock sector alone provides alternate livelihood options to over 70 million small and marginal farmers including landless labourers.

Poultry accounts for the largest share with 55% followed by others. India has about 304 million cattle, including 105 million buffaloes.

A significant number of women also find employment in the livestock sector.

Milk production in the country has increased by more five times between 1960-2009. This can be attributed mainly to the successful implementation of ‘operation flood’.

Meat, eggs, wool and other by-products are also emerging as important productive sectors for diversification.

In numbers, our livestock population is quite impressive but its productivity is quite low as compared to other countries.

It requires improved technology and promotion of good breeds of animals to enhance productivity.

Improved veterinary care and credit facilities to small and marginal formers and landless labourers would enhance sustainable livelihood options through livestock production.

Operation Flood

It is a system whereby all the farmers can pool their milk produced according to different grading (based on quality) and the same It is processed and marketed to urban centres through cooperatives

In this system farmers are assured of fair price and Income from the supply of the milk to urban markets. Gujarat state is held as a success story in the efficient implementation of milk cooperatives which has been emulated by many states.

Fisheries

The socio-economic status of fishermen is comparatively lower because of rampant underemployment, low per capital earnings absence of mobility of labour to other sectors

high rate of illiteracy indebtedness

Horticulture

As India has variable climate and soil conditions, India has adopted growing of diverse horticultural crops such as fruits, vegetables, tuber crops, flowers, medicinal and aromatic plants, spices and plantation crops.

These crops play an important role in providing food, nutrition and employment. The period between 1991-2003 is called ‘golden revolution’ because during this period, the planned investment in horticulture became highly productive and the sector emerged as a sustainable livelihood option

India has emerged as a world leader in producing a variety of fruits, like mangoes, bananas, coconuts, cashew, nuts and a number of species and is the second largest producer of fruits and vegetables.

Economic conditions of many formers engaged in horticulture has improved and has become a means of improving livelihood for many unprivileged classes.

Flower harvesting, nursery maintance, hybrid seed production and tissue culture, propagation of fruits and flowers and food processing are highly profitable employment opportunities for rural women. It has been estimated that this sector provides employment to around 19% of the total labour force.

Other Alternate Livelihood Options

The Information Technology (IT) has revolutionised many sectors in the Indian economy.

It plays a very significant role in achieving sustainable development and food security in the following ways

i)It can act as a tool for releasing the creative potential and knowledge embedded in our people ii)Issues like weather forecast, crop treatment, fertilisers, pestisides storage conditions, etc can be well administered, if expert opinion is made available to the farmers

.iii)The quality and quantity of crops can be increased manifold, if the farmers are made aware of the latest equipments, technologies and resources.

iv)It has ushered in a knowledge economy.

v)It has potential of employment generation in rural areas.

Every Village A Knowledge Centre

MS Swaminathan Research Foundation, an institution located in Chennai, Tamil Nadu, with support from Sir Ratan Tata Trust, Mumbai, has established the Jamshedji Tata National Virtual Academy for Rural Prosperity.

The academy envisaged to identify a million grass root knowledge workers who will enlisted as fellows of the academy.

The programme provides an info-kiosk (PC with internet and video conferencing facility, scanner, photocopier, etc) at a low cost and trains kiosk owner; the owner then provides different services and tries to earn a reasonable income. The Government of India has decided to join the alliance by providing financial support of Rs. 100 crore.

Sustainable Development and Organic Farming

Conventional agriculture uses chemical fertilisers and toxic pesticides, etc which enter the food supply, penetrate the water resources, harm the livestock, deplete the soil and devastate natural eco-system.

Due to these problems, an eco-friendly technology is required. Organic farming is such technology which restores, maintains and enhances the ecological balance. There is an increasing demand for organically grown food to enhance food safety throughout the world.

Benefits of Organic Farming

i)Organic forming substitutes costlier agriculture inputs like HYV seeds, chemical fertlisers, pesticides, etc with locally produced organic inputs that are cheaper and thereby generate good returns on investment

ii).Organic forming also generates income through exports.

iii)Organically grown food has more nutritional value than chemical forming, thus providing us with healthy foods

.iv) Produce pesticide free and produced in an environment sustainable way. Due to more labour requirement in organic farming, it is an attractive proposition for India.

Limit of Organic Farming

i)Yields from organic forming are less than modern agricultural forming in the initial years. Therefore, small and marginal formers may find it difficult to adapt to large scale production

ii)Organic produce have shorter shelf life than sprayed produce.

iii)Choice in production of off-season crops in quite limited in organic forming

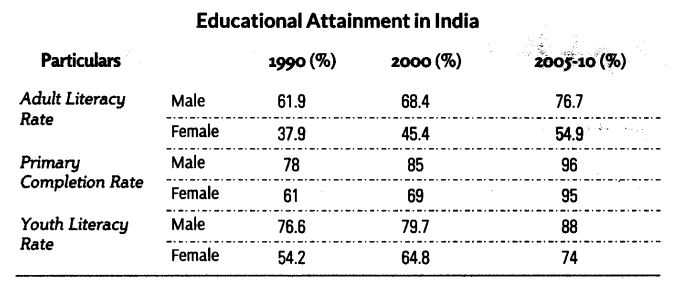

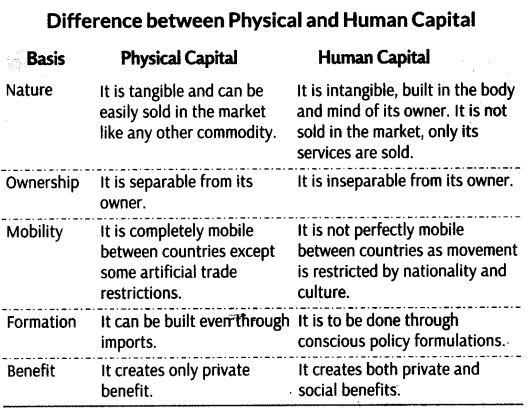

HUMAN CAPITAL FORMATION In Indian Economic part 3

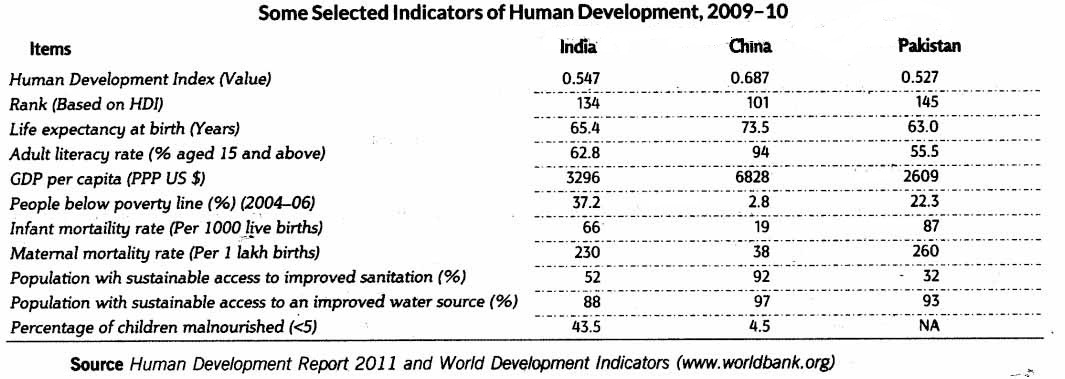

table from ncert bk

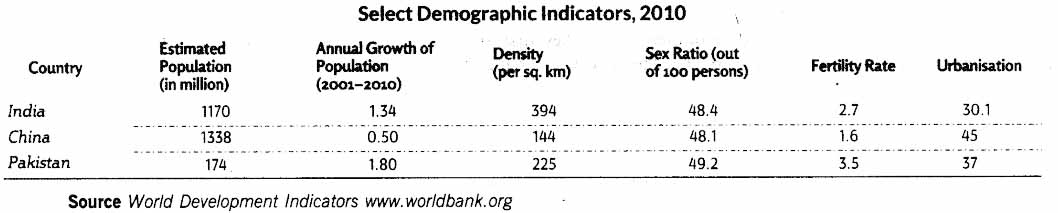

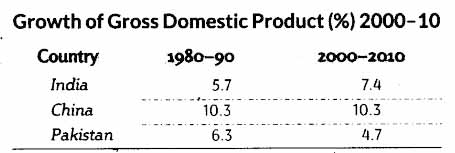

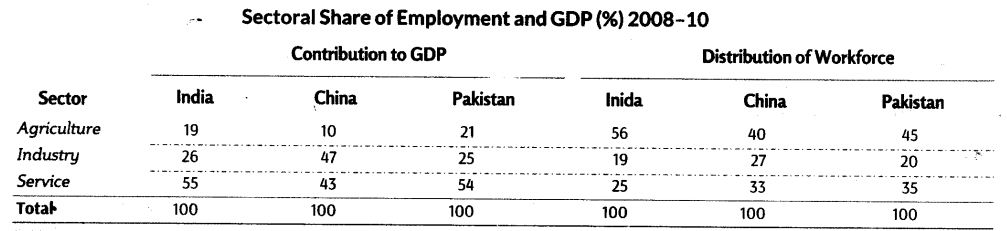

table from ncert bk

Human Capital and Economic Growth: India recognised the importance of human capital in economic growth long ago.

Human Capital and Economic Growth: India recognised the importance of human capital in economic growth long ago.