Macro Economics Basic Concept 1

Macro Economics Basic Concept 1 is the part of macro economics that covers the basic idea of unit 1 covering the whole syllabus of class 12 in the unit

BASIC CONCEPT OF MACRO ECONOMIC Macroeconomics is the part of economic theory that studies the economy as a whole, such as national income, aggregate employment, general price level, aggregate consumption, aggregate investment, etc. Its main instruments are aggregate demand and aggregate supply. It is also called the ‘Income Theory’ or ‘Employment Theory’Macroeconomics is concerned with economic problems at the level of an economy as a whole. Structure of Macroeconomics implies study of different sectors of the economy.

An economy may be divided into different sectors depending on the nature of study.

Producer sector engaged in the production of goods and services.

Household sector engaged in the consumption of goods and services. Households are the owners of factors of production.

The government sector engaged in activities like taxation and subsidies

Rest of the world sector engaged in exports and imports.

Macro Economics Basic Concept: Main points

Financial sector (or financial system) engaged in the activity of borrowing and lending.

Circular flow of income.

It is the flow of money, income or the flow of goods and services across different sectors of the economy in a circular form.

There are two types of Circular flow:

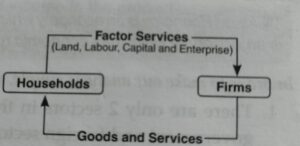

(a) Real/Product/Physical Flow

(b) Money/Monetary/Nominal Flow

(a) Real flow of income implies the flow of factor services from the household sector to the producing sector and corresponding flow of goods and services from the producing sector to the household sector.

Let us consider a simple economy consisting only of 2 sectors:

• Producer Sector.

• Household Sector.

These two sectors are dependent on each other in the following ways:

Producers supply goods and services to the households.

Household (as the owners of factors of production) supplies factors of production (or factor services) to the producers.

This interdependence can be explained with the help of the diagram given here.

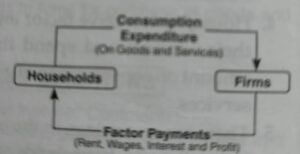

Money Flow

Money flow is the flow of factor income, as rent, interest, profit and wages from the producing sector to the household sector as monetary rewards for their factor services as shown in the flowchart.

The households spend their incomes on the goods and services produced by the producing sector. Accordingly, money flows back to the producing sector as household expenditure as shown in the flowchart.

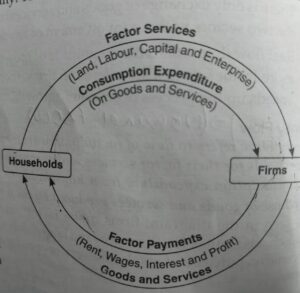

Circular Flow Of Income In Two Sector Model:

The two sector of economic activity are:

There are only two sectors in the economy; that is, household and firms. Household supply factor services to firms. Firms hire factor services from Households. Households spend their entire income on consumption. Firms sell all that is produced to the households. There is no government or foreign trade. Such an economy described above has two types of markets.

Market for goods and services, that is product market. Market for factors of production, factor market.

In the case of our simple economy: Total production of goods and services by firms = Total consumption of goods and services by Household Sector.

Factor Payments by Firms = Factor Incomes of Household Sector.

Consumption expenditure of Household sector = Income of Firm.

Therefore Real flows of production and consumption of Firms and households = Money flows of income and expenditure of Firms and Households.

Some Basic Concepts Of MacroEconomics

Factor Income

Income earned by factor of production by rendering their productive services in the production process is known as Factor Income. It is a bilateral /Two-Sided Concept.

It is included in National Income as it contribute something in the flow of goods and services.

Examples: Rent, interest, wages and profit.

Transfer Income: Income received without rendering any productive services is known as transfer income. It is a unilateral [one-sided] concept.It is not included in National Income as it does not contribute anything in the flow of goods and services.

Examples: Old Age Pension, Scholarship, Unemployment allowance.

There are two types of transfers Income

Current Transfers

Transfers made from the income of the payer and added to the income of the recipient (who receive) for consumption expenditure are called current transfers.It is recurring or regular in nature.

For example, scholarships, gifts, old age pension, etc.

Capital Transfers are defined as transfers in cash and in kind for the purpose of investment to recipients, made out of the wealth or saving of the donor.

It is non recurring or irregular in nature.

For example, investment grant, capital gains tax, war damages, etc.

Stock

Any economic variable which is calculated at a particular point of time is known as stock. It is static in nature, i.e., it do not change.

There is no time dimension in stock variables.

For example, Amount of Money, Money Supply, Water in Tank, etc.

Flow Any economic variable which is calculated during a period of time is known as flow. It is dynamic in nature, i.e., it can be changed. There is time dimension in flow variables.

For example, Speed, Spending of Money, Water in River, Exports, Imports, etc.

Economic territory or Domestic Territory:

It is the geographical territory administered by a government within which persons, goods and capital circulate freely.

(b) The definition is based on “freedom of circulation of persons, goods and capital”, those parts of the political frontiers (or boundaries) of a country where the government of that country does not enjoy the above “freedom” are not to be included in economic territory of that country.

One example is embassies. Government of India does not enjoy the above freedom in the foreign embassies located within India. So, these are not treated as a part of economic territory of India. They are treated as part of the economic territories of their respective countries. For example the UK. embassy in India is a part of economic territory of the UK in the same way the Indian embassy in London is a part of economic territory of India.

International organizations like UNO, WHO, etc. located within the geographical boundaries of a country.

In simple terms, the domestic territory of a nation is understood to be the territory lying within the political frontiers (or boundaries) of a country. But in national income accounting, the term domestic territory is used in a wider sense. Based on ‘freedom’ sense of the scope economic territory is defined to cover:

Ships and aircrafts owned and operated by normal residents between two or more countries. For example, Indian Ships moving between USA and India regularly are part of domestic territory of India. Similarly, planes operated by Air India between Canada and Australia are part of the domestic territory of India. Similarly, planes operated by Tiwan Airlines between India and Japan are a part of the domestic territory of Tiwan.

Fishing vessels, oil and natural gas rigs and floating platforms operated by the residents of a country in the international waters where they have exclusiverights of operation. For example, Fishing boats operated by Indian fishermen in international waters of Indian Ocean will be considered a part of domestic territory of India.

Embassies, consulates and military establishments of a country located abroad. For example, Indian Embassy in Russia is a part of the domestic territory of India. ‘Consulate’ is an office or building used by consul (an officer commissioned by the government to reside in a foreign country to promote the interest of the countiy to which he belongs).

Citizenship

Citizenship is basically a legal concept based on the place of birth of the person or some legal provisions allowing a person to become a citizen. It means, Indian citizenship can arise in two ways: When a person is born in India, he acquires automatic citizenship of India.

A person born outside India applies for citizenship and Indian Law allows him to become Indian Citizen.

Normal Resident/Resident

A Normal residenf, whether a person or an institution, is one whose centre of economic interest lies in the economic territory of the country in which he lives.

The centre of economic interest implies in two things:

The resident lives or is located within the economic territory for more than one year and

( The resident carries out the basic economic activities of earnings, spending and accumulation from that location

(c) There is a difference between the terms normal resident (resident) and citizen (or national).

A person becomes a national of a country because he was born in the country or on the basis of some other legal criterion.

A person is treated resident of a country on the basis of economic aspects working for economic development of the country

It is not necessary that a resident must also be the national of that country. Even foreigners can be the residents if they pass the above stated economic criterion.

For example, a large number of Indian nationals have settled in U.S.A., England, Australia, etc. as residents (and not as nationals) of these countries. For India, they are Non-resident Indians (NRI) but continue to remain Indian nationals.

Following are not included under the category of Normal residents:

Foreign visitors in the country for such purposes as recreation, holidays, medical treatment, study tours, conferences, sports events, business etc. (they are supposed to stay in the host country for less than one year.

In case they continue to stay for one year or more in the host country, they will be treated as normal residents of the host country).

Crew members of foreign vessels, commercial travelers and seasonal workers in , the country (Foreign workers who work part of the year in the country in response to the varying seasonal demand for labour and return to their households and border workers who regularly cross the frontier each day or somewhat less regularly, (i.e. each week) to work in the neighbouring country are the normal residents of their own countries. Example: Nepal.

Officials, diplomats and members of the armed forces of a foreign country.

International bodies like World Bank, World Health Organisation or International Monetary Fund are not considered residents of the country in which these organisations operate but are treated as residents of international territory.

However, the staffs of these bodies are treated as normal residents of the country in which the international body operates.

For example, international body like World Health Organisation located in India is not normal resident of India but Americans working in its office for more than a year will be treated as normal residents of India.

Foreigners who are the employees of non-resident enterprises and who have come to the country for purposes of installing machinery or equipment purchased from their employers. (They are supposed to stay for less than one year. In case they continue to stay for one year or more, they will be treated as normal residents of the host country).

Final Goods in macro economics basic concepts are the goods that are used for Personal Consumption (like bread purchased by consumer household),

Investment / Capital Formation (like building, machinery purchased by a firm)

Final goods are those, which require no further processing and are available in an economy for consumption purpose or investment. These give direct satisfaction to a consumer.

Production boundary, it is a good that crosses the imaginary line around the production unit and reaches to final consumer or investment made by a producer within the imaginary line of production unit is known as the final good.

Intermediate Goods in macro economics basic concepts are the goods that are used for Further processing (like sugar used for making sweets); or Resale in the same year (If car purchased by car dealer for resale).

In other words, intermediate goods are the ones, which require further processing and are not available in an economy for the purpose of consumption. These goods give indirect satisfaction to a consumer.

In the production boundary, that goods do not cross the imaginary line around the production unit and reaches to other firm within the production boundary, is known as intermediate good.

Difference between Final Goods and Intermediate Goods

If a good is used for Personal consumption; or Investment Then it is a final good, whereas, if a good is used for Further processing; or Resale in the same year, then it is known as intermediate good.

For example, bread used by a consumer household is a final goods, but the same used by a bakery for making a sandwich is a intermediate goods.

The production boundary is the imaginary line around the production unit., if a good crosses the imaginary line around the production unit and reaches to final consumer or investment made by a producer within the imaginary line of production unit, it is known as final good

If a good does not cross the imaginary line around the production unit and reaches to other firm within the production boundary, it is known as intermediate good. Within this limit, wheat and flour are intermediate goods.

Bread is final good as it lies outside the purview of production boundary.

Important Points :Intermediate Goods: As far as intermediate consumption of general government is concerned ordinary writing paper, pencils and pens to sophisticated fighter aircrafts. The intermediate consumption of the general government includes the following items:

Value of all Non-durable Goods and Services such as petrol, electricity, lubricants, stationery, soaps, towels etc. Non-durable goods and services are those which have an expected life time of use of less than one year.

Repair and maintenance of capital stock mean expenditure incurred for maintaining fixed assets and keep them in good working order. This includes the expenditure on new parts of the fixed assets. The life of the new parts may be around one year or slightly more and the value should be relatively small.

For example, replacement of the tyres of a truck is an intermediate consumption, but not the replacement of its engine.

Expenditure on Military Equipment missiles, rockets, bombs, warships, submarines, military aircrafts, tanks, missile carriers and rocket-launchers etc. whose function is to release weapons. Military vehicles and light weapons.

Value of goods received from foreign governments in form of gifts or as transfers. Examples of these transfers in kind are food, clothing, medicines, vegetable oils, butter, toys sent by the government of one country to the other in times of natural calamities or as a token of goodwill and friendship between two countries, the goods received for distribution to consumer households without renovation or alternation should not be included in intermediate consumption as these goods go into the final consumption of consumer households.

Production unit from other production units are intermediate purchases. For example, purchases of building, machinery, etc. are not intermediate purchases (if they are not meant for resale in the same year). Rather, these purchases are meant for investment and are termed as final product.

Research and development Commodities consumed. In research and exploratory activities (like oil exploration in different parts of India by the Oil and Natural Gas Commission) or improving the technology of a particular production process. Commodities used in basic scientific research. Advertisements, market research and public relationship meant for improving the goodwill of the business enterprises. Business expenses of the employees on tours and entertainment.

Final goods can be classified into two groups macro economics basic concepts

Consumption Goods and Capital Goods.

Consumption goods are those which satisfy the wants of the consumers directly. For example, cars, television sets, bread, furniture, air-conditioners, etc.

Durable goods: These goods have an expected life time of several years and of relatively high value. They are motor cars, refrigerators, television sets, washing machines, air-conditioners, kitchen equipments, computers, communication equipments etc.

Semi-durable goods: These goods have an expected life time of use of one year or slightly more. They are not of relatively great value. Examples are clothing, furniture, electrical appliances like fans, electric irons, hot plates and crockery.

Non-durable goods: Goods which can not be used again and again, i.e., they lose their identity in a single act of consumption are known as non-durable goods. These are foodgrains, milk and milk products, edible oils, beverages, vegetables, tobacco and other food articles.

Services: Services are non-material goods which satisfy the human wants directly. They cannot be seen or touched, i.e., they are intangible in nature. These are medical care, transport and communications, education, domestic services rendered by hired servants, etc.

Capital goods are defined as all goods produced for use in future productive processes.

For example, all the durable goods like cars, trucks, refrigerators, buildings, aircrafts, air-fields and submarines used to produce goods and are ready for sale in the market are a part of capital goods.

Stocks of raw materials, semi-finished and finished goods lying with the producers at the end of an accounting year are also a part of capital goods.

Some more examples of capital goods are machinery, equipment, roads and bridges.

National Income and Related Aggregates of macro economics basic concepts:

Gross And Net: Gross means the value of product including depreciation. Net means the value of product excluding depreciation. The difference between these two terms is depreciation.

Where depreciation is the expected decrease in the value of fixed capital assets due to its general use.

Gross = Net + Depreciation Net = Gross – Depreciation

:(a) Consumption of fixed capital (b) Capital consumption allowance(c) Current replacement cost. is the other name of depreciation.

National Income And Domestic Income:

National Income is net money value of all the final goods and services produced by the normal residents of a country during an accounting year.

Domestic Income refers to a total factor incomes earned by the factor of production within the domestic territory of a country during an accounting year.

The difference between these two incomes is Net Factor Income from abroad (NFIA), which is included in National Income (NY) and excluded from Domestic Income (DY).

Where NFIA is the difference between income earned by normal residents from rest of the world and similar payments made to Non residents within the domestic territory.

NFIA = Income earned by Residents from rest of the world (ROW) – Payments to

Non-Residents within Domestic territory.

NY = DY + NFIA DY = NY – NFIA

Case I: Income paid to abroad is given, then to make NFIA inverse the sign. Example, Income paid to abroad =500

NFIA = Income from Abroad – Income paid to abroad

= 0 – 500 = -500 and vice versa.

Case II: Income from abroad is given, then

NFIA = Income from abroad.

Example, Income from abroad =1000

NFIA = Income from Abroad- Income paid to abroad = 1000 – 0 = 1000 and vice versa

Case III: If income from abroad and income paid to abroad both are given, then NFIA is the difference between them,

Example, Income from abroad =1000 Income paid to abroad =1200

NFIA = Income from Abroad- Income paid to abroad

= 1000 – 1200 = (-) 200 and vice versa

Case IV: Net factor income to abroad be given, then to make NFIA inverse the sign.

Net factor income paid to abroad (NFPA) = income to abroad – income from abroad.

Example,

Net Factor Income to abroad (NFPA = 1000). In this NFPA is positive, which means that income to abroad is greater than income from abroad, which makes,

NFIA = (-)1000

Net Factor Income to abroad [NFPA = (-)1000]. In this NFPA is negative, which

means that income to abroad is less than income from abroad, which makes,

NFIA = (+) 100

Factor Cost And Market Price in macro economics basic concept1

Factor Cost (FC): It is the amount paid to factors of production for their contribution in the production process.

Market Price (MP): It is the price at which product is actually sold in the market.

The difference between these two is Net Indirect Taxes (NIT) which is included in MP and excluded from FC

Where NIT is the difference between indirect taxes and subsidies.

NIT = IT – Subsidies

Where, Indirect Taxes are the taxes which are levied by the government on production and sale of commodity. Sales tax, excise duty, custom duty, etc. are some of the indirect taxes, and subsidies are the cash grants given by the government to the enterprises to encourage production of certain commodities, to promote exports or to sell goods at prices lower than the free market Price. In India, LPG cylinder is sold at subsidized rates.

MP = FC + NIT (Indirect Taxes – Subsidies)

FC = MP – NIT (Indirect Taxes – Subsidies)

Case I: Subsidy is given, then to make NIT inverse the sign. For this put Indirect tax = 0.

Example, Subsidy = 1000

NIT = Indirect Tax – subsidies = 0-1000 = (-) 1000 and vice versa

Case II: IT is given, then NIT = IT (For this put subsidy 0) Example, IT = 1000

NIT = Indirect Tax – subsidies = 1000-0 = 1000 and vice versa

Case III: If IT and subsidy both are given, then NIT is the difference.

Example, IT = 1000

Subsidy = 800

NIT = Indirect Tax – subsidies = 1000-800 = 200

Indirect tax, we have to inverse the sign,

Net Subsidy = Subsidy – Indirect Tax

Gross Domestic Product at Market Price (GDPMP ): GDPMP is defined as the gross market value of the final goods and services produced within the domestic territory of a country during an accounting year by all production units.

‘Gross’ in GDPMP signifies that depreciation is included, i.e., no provision has been made for depreciation.

‘Domestic’ in GDPMP signifies that it includes all the final goods and services produced by all the production units located within the economic territory (irrespective of the fact whether produced by residents or non-residents).

‘Market Price’ in GDPMP signifies that indirect taxes are included and subsidies are excluded, i.e., it shows that Net Indirect Taxes (NIT) have been included.

‘Product’ in GDPMP signifies that only final goods and services have to be included and intermediate goods should not be included to avoid the double counting.

Gross Domestic Product at Factor Cost (GDPFC): GDPFCis defined as the gross factor value of the final goods and services produced within the domestic territory of a country during an accounting year by all production units excluding Net Indirect Tax.

GDPFC = GDPMP – Net Indirect Taxes

Net Domestic Product at Market Price (NDPMP ).

NDPMP is defined as the net market value of all the final goods and services produced within the domestic territory of a country by its normal residents and non-residents during an accounting year.

NDPMP =GDPMP – Depreciation

Net Domestic Product at Factor Cost (NDPFC ).

NDPFC refers to a total factor income earned by the factor of production within the domestic territory of a country during an accounting year.

NDPFC = GDPMP – Depreciation – Net Indirect Taxes NDPFC is also known as Domestic Income or Domestic factor income.

Gross National Product at Market Price (GNPMP).

GNPMP refers to market value of all the final goods and services produced by the normal residents of a country during an accounting year.

GNPMP = GDPMP + Net factor income from abroad It must be noted that GNPMP can be less than GDPMP when NFIA is negative. However, GNPMP will be more than GDPMP when NFIA is positive.

Gross National Product at Factor Cost (GDPFC) or Gross National Income GNPFC refers to gross factor value of all the final goods and services produced by the normal residents of a country during an accounting year.

GDPFC = GNPMP – Net Indirect Taxes

Net National Product at Market Price (NNPMP ).

NNPMP refers to net market value of all the final goods and services produced by the normal residents of a country during an accounting year.

NNPMP = GNPMP – Depreciation

Net National Product at Factor Cost (NNPFC ).

NNPFC refers to net money value of all the final goods and services produced by the normal residents of a country during an accounting year.

NNPFC = GNPMP – Depreciation – Net Indirect Taxes

It must be noted that NNPFC is also known as National Income.

How To Determine National Income in macro economic basic concept

There are three methods of calculating national income.

These are:

(a) Income Method

(b) Expenditure Method

(c) Value Added Method/Product Method/Output Method

National Income determination under income method:

“Production creates income”. If we want to calculate National Income by Income method, then we have to add different factor incomes from the economy.

The addition of all these factor incomes gives us the calculation near by the

National Income, i.e., Net Domestic Product at FC (NDPfc).

Components of Income Method

Compensation Of Employees (COE)/Emoluments of employees: The amount earned by employees from their employers, whether in cash or in kind or through any

other social security scheme is known as compensation of employees.

This is broadly divided into the following three components:

(a) Wages and Salaries payable in Cash:

(i) Wages and salaries receivable by the employees

(ii) Special allowances for working overtime.

(iiij Cost of travel to and from work, and car parking.

(iv) Bonuses

(v) Commissions, gratuities, tips, cost of living (i.e., dearness allowance paid in our country) honorarium, vacation, sick leave allowance etc.

(vi) Pensions at the time of retirement (Deferred Wage):

(b) Wages and Salaries in Kind: It includes:Meals and drinks including those consumed when travelling for business.

The services of vehicles or other durables provided for the personal use of the employees. Goods and services produced as outputs from the employer’s own process of production such as free travel for the employees of railways or airlines, or free coal for miners. Sports, recreation or holiday facilities for employees and their families. Creches for children of employees.

Operating Surplus: It is as “value of gross output less the sum of intermediate consumption, compensation of employees, mixed income, depreciation and NIT.”

Operating Surplus = GVO mp – Intermediate consumption – COE – Mixed Income – Depreciation – NIT

In other words, it is the sum of income from property and income from entrepreneurship. Operating surplus have the following two components:

Income from property: It is the income which has been arisen from rent, interest and royalty.

It is divided into three components:

Rent: The income arising from ownership of land and building is known as rent. It also includes imputed rent. If a person living in his own house, then it is assumed in an economy that he is paying rent to himself. This concept is known as imputed rent.

Royalty: Royalties are the payments made for the use of mineral deposits such as coal, oil, etc. or for the use of patents, copyrights, trademarks, etc.

Interest: It is the amount earned for lending funds to the production units. It also includes imputed interest of funds provided by entrepreneur. But interest income includes interest on loan taken for productive services only.

The following categories of interest should not be included :

Interest on national debt or interest paid by government on nation debt should not be included

(b) Income from entrepreneurship: It is a return of entrepreneur after paying all the other factors of production. It is of the following three types:

(i) Distributed Profit (Dividend): It is that part of total profit which is given to shareholders.

The thing to be noted here is that profit earned by one firm to another should not be included under this head .

(ii) Undistributed Profit (Saving of private corporate sector or Retained earnings):It is that part of total profit which is not given to shareholders and kept as a reserve for future uncertainties.

(iii) Corporation Tax (Profit Tax): It is that part of total profit which is given by a firm to the government as Tax.

The concept of operating surplus is applicable to all producing enterprises, whether they belong to the private sector or to the government. The government enterprises also are expected to earn reasonable rate of profit on the funds invested.

But, operating surplus does not arise in the general government sector as they produce goods and services for the social welfare of the country and not for profit motive i.e., why rent, interest and profit are zero in general government sector.

Mixed Income: Income of own account workers (like farmers, doctors, barbers, etc.) and unincorporated enterprises (like small shopkeepers, repair shops) is known as mixed income. They do not maintain proper accounts.

They do not generally hire factor services from the market rather use their own resources like land, labour, funds, etc. As the result of, it becomes difficult to classify their income distinctly among rent, wages, interest and profit.

NDPFC= Compensation of employees (COE) + Operating surplus (OS) + Mixed Income

National Income = NDP fc+ NFIA

Profit earned by one firm to another should not be included because it is a part of intermediate consumption.

If Profit after tax is given and corporate tax is given, the adding them we get profit. Profit after tax = 1000

Corporate tax =100 Profit =1100

If Profit before tax and corporate tax are given, then ignore corporate tax.

Profit before tax = 1000

Corporate tax =100 Profit = 1000

Steps for calculating national income by income method:

Step1 To identify enterprises which employ primary factors (Land, Labour, Capital, enterprise).

Step 2: To classify various types of factor income like:

(a) Compensation of employees: The amount earned by employees from their employer, whether in cash or in kind or through any other social security scheme is known as compensation of employees.

(b) Operating Surplus: It is the sum of income from property and income from entrepreneurship.

(c) Mixed Income: Income of own account workers (like farmers, doctors, barbers, etc.) and unincorporated enterprises (like small shopkeepers, repair shops) is known as mixed income.

Step 3: To estimate amount of factor payments made by each producing unit.

Step 4: To add all factor incomes / payments within domestic territory to get domestic income, i.e., NDPFC .

NDPFC = Compensation of employees + Operating Surplus + Mixed Income

Step 5: Addition of NFIA to NDPFC to get NY, i.e., NNPFC .

Precautions of income method.

(a) Avoid transfers: National income includes only factor payments, i.e., payment for the services rendered to the production units by the owners of factors.

Any payment for which no service is rendered is called a transfer, not a production activity. Gifts, donations etc. are main examples. Since transfers are not a production activity it must not be included in national income.

(b) Avoid capital gain: Capital gain refers to the income from the sale of second hand goods and financial assets. Income from the sale of old cars, old house, bonds, debentures, etc. are some examples.

These transactions are not production transactions. So, any income arising to the owners of such things is not a factor income.

(c) Include income from self-consumed output: When a house owner lives in his house, he does not pay any rent. But infact he pays rent to himself. Since, rent is a payment for services rendered, even though rendered to the owner itself, it must be counted as a factor payment.

(d) Include free services provided by the owners of the production units: Owners work in their own unit but do not charge salary. Owners provide finance but do not charge any interest.

Owners do production in their own buildings but do not charge rent. Although they do not charge, yet the services have been performed. The imputed value of these must be included in national income.

National Income By Expenditure Method And Its Steps And Precautions:

National income determination by Expenditure method:

(a) “Production creates income, income creates expenditure” in macro economics basic concept 1 If we want to calculate National Income by this method, we have to add different final expenditures from an economy.

(b) The addition of all those final expenditure gives us the calculation near by the National Income, i.e. GDPMP .

Components of Expenditure Method

Government Final Consumption Expenditure (GFCE): , GFCE = Intermediate consumption of government + Compensation of employees (wages and salaries in cash and in kind) by government + Direct purchases made abroad by government (purchases made by embassies and consulates located in foreign countries) + Consumption of fixed capital (depreciation) – Sale of goods and services by government.

Private Final Consumption Expenditure (PFCE):

PFCE = Household final consumption expenditure + Private non-profit Institution serving households final consumption expenditure.

PFCE = Purchases of currently produced goods and services in the domestic Market by consumer households and NPISH households + direct purchases made abroad by resident households – direct purchases in domestic market by non¬resident households.

Household Final Consumption Expenditure = Personal disposable income – Personal (Household) Saving

Gross Domestic Capital Formation or Gross Investment or Investment Expenditure:

It refers to additions to the physical stock of capital during a period of time. It includes building machinery, Housing construction, construction of factories, etc. It has been classified into the following categories.

Gross Domestic Fixed Capital Formation (GDFCF): It is the expenditure incurred on purchase of fixed assets. It is of three types:

Gross Business Fixed Investment:

Gross Business Fixed Investment = Net Business fixed Investment + Depreciation

Gross Residential Construction Investment:

(iii) Gross Public Investment:

(b) Change In Stock (Closing Stock – Opening Stock)

(c) Net Acquisition Of Valuables: These are those high value durable goods like gold, silver, amtiques, etc. which are taken at market price. (Net Domestic Capital Formation)

GDCF = Gross domestic fixed capital formation (GDFCF) + Change in Stock (Closing Stock – Opening Stock)

Or

GDCF=Net domestic fixed capital formation + Change in stock + Depreciation

GDCF = Net Domestic Capital formation + Depreciation

Net Export (Export – Import): It shows the difference between Domestic spending on foreign goods (i.e., imports) and foreign spending on domestic goods (i.e., exports).Thus, the difference between exports and imports of a country is called Net Exports.

Net Exports = Export – Import

GDPmp = Government final consumption expenditure + Private final consumption expenditure + Gross domestic capital formation + Net export

NATIONAL INCOME = GDPmp- depreciation -NIT + NFIA

VALUE AD D METHOD in macro economics basic concept 1

Value Added is the difference between the output and intermediate consumption .the value of output is the sum of total sales and change in stock ( closing stock – opening stock)

value of output =Total sales+ change in stock

Value Added = Value of Output – Intermediate Consumption

National Income = Gross Value Added by Primary , Secondary, Tertiary Sectors – Depreciation – NIT + NFIA

NOMINAL GDP at current price: When GDP of the given year is estimated on the basis of price of the same year .

REAL GDP at constant price : When GDP of a given year is estimated on the basis of price of base year.

Real GDP=(Nominal GDP ×100)÷ Price Index

Conclusion : Macro Economics basic concept

after reading Macro Economics Basic Concept 1, you can able to understand marco economics basics concept in right way.

Follow us on Instagram

Also read: MACRO ECONOMICS part 5