Macro Economics Part3

Macro Economics part 3 consist of study of Balance of payment and Foreign exchange according to syllabus of class 12

Balance Of Payment in Macro Economics Part3:

The balance of payments in Macro Economic Part 3 of a country is a systematic record of all economic transactions between its residents and residents of the foreign countries during a given period of time.

Economic transactions in Macro Economics are the transactions which cause transfer of value but incase foreign transactions value is transferred by the residents of one country to the residents of other country.

Example:

when exports of goods or services are made by country inform of export receipt and import from other country as import payments,

Balance of Payment Accounting in Macro Economics 3:

Transactions are recorded in the balance of payments accounts in Macro Economics is double-entry book keeping.

Each international transaction undertaken by country will results in a credit entry and debit entry of equal size.

As international transactions are recorded in double entry accounting, the BOP accounting must always balance in macro economics i.e., total amount of debts must be equal to total amount of credits.

The balancing item Errors and omissions must be added to “balance” the BOP accounts.

By convention, debt items and credit items are entered with a minus sign and plus sign respectively.

Transactions in BOP are classified into the following five major categories (i)Goods and services account

(ii)Unilateral transfer account

(iii)Long-term capital account

(iv) Short-term private capital account

(v)Short-term official capital account

Current Account in Macro Economics Part3:

It records imports and exports of goods and services and unilateral transfers in Macro Economics.

Components of Current Account in Macro Economics Part 3:

The main components of Current Account in Macro Economics are:

Export and Import of Goods (Merchandise Transactions or Visible Trade):

A major part of transactions in foreign trade is in the form of export and import of goods (visible items).

Payment for import of goods is written on the negative side (debit items) and receipt from exports is shown on the positive side (credit items).

Balance of these visible exports and imports is known as balance of trade (or trade balance) in the Macro Economics .

Export and Import of Services (Invisible Trade):

It includes a large variety of non-factor services (known as invisible items) sold and purchased by the residents of a country, to and from the rest of the world.

Payments are either received or made to the other countries for use of these services.

Services are generally of three kinds:

(a) Shipping,

(b) Banking, and

(c) Insurance.

Payments for these services are recorded on the negative side and receipts on the positive side.

Unilateral or Unrequited Transfers to and from abroad (One sided Transactions):

Unilateral transfers include gifts, donations, personal remittances and other ‘one-way’ transactions in Macro Economics.

These refer to those receipts and payments, which take place without any service in return.

Receipt of unilateral transfers from rest of the world is shown on the credit side and unilateral transfers to rest of the world on the debit side.

Income receipts and payments to and from abroad: It includes investment income in the form of interest, rent and profits.

Capital Account in Macro Economics Part 3: is that account which records all such transactions between residents of a country and rest of the world which cause a change in the asset or liability status of the residents of a country or its government.

Components of Capital Account:

The main components of capital account are:

Loans:

Borrowing and lending of funds are divided into two transactions:

• Private Transactions:

These are transactions that are affecting assets or liabilities by individuals, businesses, etc. and other non-government entities. The bulk of foreign investment is private.

For example, all transactions relating to borrowings from abroad by private sector .

All transactions of lending to abroad by private sector and similarly repayment of loans to abroad by private sector is recorded as negative or debit item.

• Official Transactions :

Transactions affecting assets and liabilities by the government and its agencies.

For example, all transactions relating to borrowings from abroad by government sector .

All transactions of lending to abroad by government sector and similarly repayment of loans to abroad by government sector is recorded as negative or debit item.

Private and official transactions borrowing in Macro Economics Part 3:

Foreign Investment (Investments to and from abroad)in Macro Economics Part 3:

It includes Investments by rest of the world in shares of Indian companies, real estate in India, etc.

Such investments from abroad are recorded on the positive (credit) side as they bring in foreign exchange.

Investments by Indian residents in shares of foreign companies, real estate abroad, etc.

Such investments in Macro Economics to abroad are recorded on the negative (debit) side as they lead to outflow of foreign exchange.

‘Investments to and from abroad’ in Macro Economics includes two types of investments:

Foreign Direct Investment (FDI)

It refers to purchase of an asset in rest of the world, such that it gives direct control to the purchaser over the asset.

For example, (i) acquisition of a firm in the domestic country by a foreign country’s firm.

(ii) transfer of funds from the parent company abroad to the subsidiary company in the domestic country.

Portfolio Investment

Portfolio Investment refers to the purchase of financial asset by the foreigners that does not give the purchaser control over the asset.

A foreign Institutional Investment (FII) is also a part of portfolio investment.

For instance,:

purchase of shares of a foreign company, purchase of foreign government’s bonds, etc. are treated as portfolio investments.

Change in Foreign Exchange Reserves in Macro Economics Part 3

• The foreign exchange reserves are the financial assets of the government held in.

• central bank. A change in reserves serves as the financing item in India’s BOP.

• So, any withdrawal from the reserves is recorded on the positive (credit) side and any addition to these reserves is recorded on the negative (debit) side.

• It must be noted that ‘change in reserves’ is recorded in the BOP account and not ‘reserves’.

Balance Of Payments and Its Types in Macro Economics Part 3:

It means difference between the sum of credits and sum of debts. The BOP account records three balances:

(a) Balance of trade

(b) Balance on current account

(c) Balance on capital account

Balance of trade in Macro Economics:

The term “balance of trade” denotes the difference between the exports and imports of goods in a country.

Balance of trade refers to the visible items only.

It is the difference between the value of merchandise (goods) exports and imports.

Balance of Trade = Export of visible goods – Import of visible goods.

Balance on current account in Macro Economics:

It is the difference between sum of credits and sum of debits on current account.

Balance on Current Account = Sum of credits on current account – Sum of debts on current account

Balance on capital account In Macro Economics:

It is the difference between sum of credits and sum of debits on capital account.

Balance on capital account = Sum of credits on capital account – Sum of debts on capital account

1. Autonomous items in macro economics

(a) Autonomous items refer to those international economic transactions in the

current account and capital account which take place due to some economic motive such as profit maximization.

(b) These transactions are independent of the state of BOP account.

(c) These items are also known as ‘above the line items’.

(d) For example, if a foreign company is making investments in India with the aim of earning profit, then such a transaction is independent of the country’s BOP situation.

2. Accommodating items in Macro Economics Part 3

(a) Accommodating items refer to the transactions that are undertaken to cover deficit or surplus in autonomous transactions, i.e., such transactions are determined by net consequences of autonomous transactions.

(h) These items are also known as ‘below the line items’.

(c) For example, if there is a current account deficit in BOP, then this deficit is settled by capital inflow from abroad. The sources used to meet a deficit in BOP, are: (i) Foreign exchange reserves; (ii) Borrowings from IMF or foreign monetary authorities.

3. Deficit in BOP in Macro Economics Part3

(a) The balance of payments of a country is a systematic record of all economic transactions between the residents of foreign countries during a given period of time.

(b) The transaction in the balance of payment account can be categorized as autonomous transactions and accommodating transactions.

(c) Autonomous transactions are transactions done for some economic consideration such as profit.

(d) When the total inflows on account of autonomous transactions are less than total outflows on account of such transactions, there is a deficit in the balance of payments account.

(e) Suppose, the autonomous inflow of foreign exchange during the year is $500, while the total outflow is $600. It means that there is a deficit of $100.

4. Disequilibrium in Balance of Payments in Macro Economics Part 3:

There are a number of factors that cause disequilibrium in the balance of payments in Macro Economics showing either a surplus or deficit.

These causes are:

(a) Economic Factors

(i) Large scale development expenditure that may cause large imports.

(ii) Cyclical fluctuations in general business activity such as recession or depression.

(iii) High domestic prices may result in imports.

(b) Political Factors:

Political factors instability may cause large capital outflows and hamper the inflows of foreign capital.

(c) Social Factors:

Changes in tastes, preference and fashions of the people bring disequilibrium in BOP by inflowing imports and exports.

Foreign Exchange Rate in Macro Economics Part 3

Foreign Exchange and Concepts in Macro Economics

1. Foreign exchange refers to all the currencies of the rest of the world other than the domestic currency of the country. For example, in India, US dollar is the foreign exchange.

2. The rate at which one currency is exchanged for another is called Foreign Exchange Rate in Macro Economics .

In other words, the foreign exchange rate is the price of one currency stated in terms of another currency.

For example, if one Euro exchanges for 100 Indian rupees, then the rate of exchange is 1euro = Rs. 100 or 1 Rs = .01 euro

3. Foreign exchange market in Macro Economics is the market where the national currencies are converted, exchanged or traded for one another.

4. Functions of a foreign exchange market in Macro Economics

(a) Transfer Function:

It refers to transferring of purchasing power among countries.

(b) Credit Function:

It implies provision of credit in terms of foreign exchange for the export and import of goods and services across different countries of the world.

(c) Hedging Function:

It protects against foreign exchange risks. Hedging is an activity which is designed to minimize the risk of loss.

5. Sources of demand of foreign exchange in Macro Economics Part 3

The demand (or outflow) of foreign exchange comes from the people who need it to make payments in foreign currencies. It is demanded by the domestic residents for the following reasons:

(a) Imports of Goods and Services:

When India imports goods and services, foreign exchange is demanded to make the payment for imports of goods and services.

(b) Tourism:

Foreign exchange is demanded to meet expenditure incurred in foreign tours.

(c) Unilateral Transfers Sent Abroad:

Foreign exchange is required for making unilateral transfers like sending gifts to other countries.

(d) Purchase of Assets in Foreign Countries:

It is demanded to make payment for purchase of assets, like land, shares, bonds, etc. in foreign countries.

(e) Repayment of loans to Foreigners:

As and when we have to pay interest and repay the loans to foreign lenders, we require foreign exchange.

(d) Speculation:

Demand for foreign exchange arises when people want to make gains from appreciation of currency.

6. Reasons for ‘Rise in Demand’ for Foreign Currency in Macro Economics Part 3:

The demand for foreign currency rises in the following situations:

(a) When price of a foreign currency falls, imports from that foreign country become cheaper. So, imports increase and hence, the demand for foreign currency rises.

For example, if price of 1 euro falls from Rs. 100 to Rs. 90, then imports from the European will increase as European goods will become relatively cheaper. It will raise the demand for euro

(b) When a foreign currency becomes cheaper in terms of the domestic currency, it promotes tourism to that country. As a result, demand for foreign currency rises.

(c) When price of a foreign currency falls, its demand rises as more people want to make gains from speculative activities.

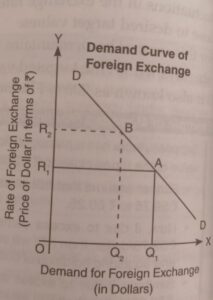

7. Demand curve of foreign exchange in Macro Economics is downward sloping:

(a) Demand curve of foreign exchange slopes downwards due to inverse relationship between demand for foreign exchange and foreign exchange rate.

(b) In figure, demand for foreign exchange (US dollar) and rate of foreign exchange are shown on the horizontal axis and vertical axis respectively.

(c) The demand curve [US$] is downward sloping. It means that less foreign exchange is demanded as the exchange rate increase

(d) This is due to the fact that rise in the price of foreign exchange increases the rupee cost of foreign goods, which make them more expensive.

As a result, imports decline. Thus, the demand for foreign exchange also decreases.

8. Sources of supply of foreign exchange in Macro Economics Part 3:

The supply (inflow) of foreign exchange comes from the people who receive it due to the following reasons.

(a) Exports of Goods and Services:

Supply of foreign exchange comes through exports of goods and services.

(b) Tourism:

The amount, which foreigners spend in the home country, increases the supply of foreign exchange.

(c) Remittances (unilateral transfers) from Abroad: Supply of foreign exchange increases in the form of gifts and other remittances from abroad.

(d) Loan from Rest of the world:

It refers to borrowing from abroad. A loan from U.S. means flow of U.S. $ from U.S. to India, which will increase supply of Foreign exchange.

(e) Foreign Investment:

The amount, which foreigners invest in our home country, increases the supply of foreign exchange.

(f) Speculation:

Supply of foreign exchange comes from those who want to speculate on the value of foreign exchange.

9. Reasons of‘ rise in supply’ of foreign currency Macro Economics Part 3:

The supply of foreign currency rises in the following situations:

(a) When price of a foreign currency rises, domestic goods become relatively cheaper. It induces the foreign country to increase their imports from the domestic country. As a result, supply of foreign currency rises.

For example, if price of 1 US dollar rises from Rs. 60 to Rs. 65, then exports to USA will increase as Indian goods will become relatively cheaper. It will raise the supply of US dollars.

(b) When price of a foreign currency rises, foreign direct investment (FDI). from rest of the world increases, which will increase the supply for foreign exchange.

(c) When price of a foreign currency rises, supply of foreign currency also rises as people want to make gains from speculative activities.

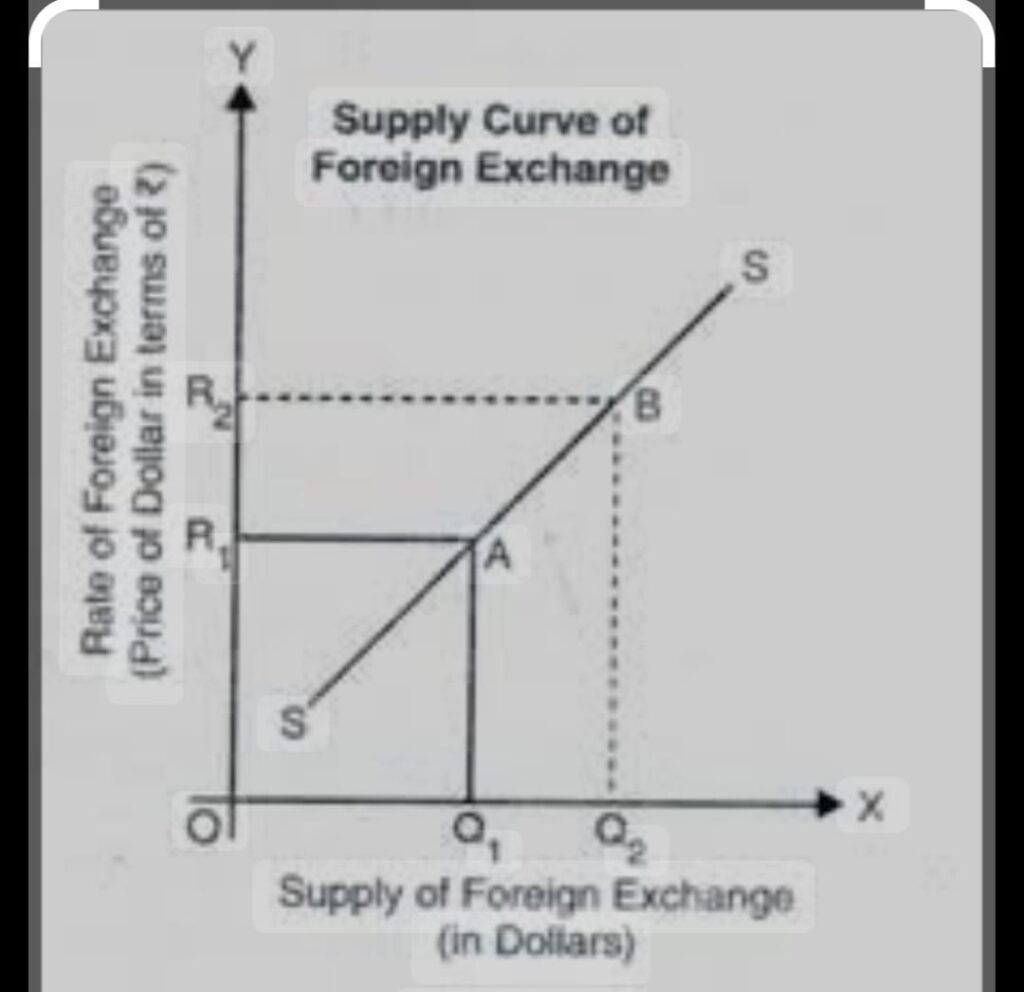

10. Supply curve of foreign exchange is upward sloping in Macro Economics

(a) Supply curve of foreign exchange slopes upwards due to positive relationship between supply for foreign exchange and foreign exchange rate, which means that supply of foreign exchange increases as the exchange rate increases.

(b) This makes home country’s goods become cheaper to foreigners since rupee is depreciating in value. The demand for our exports should therefore increase as the exchange rate increases.

(c) The increased demand for our exports will translate into greater supply of foreign exchange.

Thus, the supply of foreign exchange increases as the exchange rate increases.

How Foreign Exchange Is Determine, Disequilibrium Conditions Under Exchange Rate

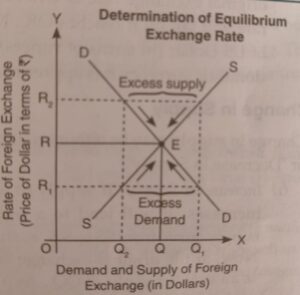

1. Determination of foreign exchange rate:

(a) Exchange rate in a free exchange market is determined at a point, where demand for foreign exchange is equal to the supply of foreign exchange.

(b) Let us assume that there are two countries – India and U.S.A – and the exchange rate of their currencies i.e., rupee and dollar is to be determined.

Presently, there is floating or flexible exchange regime in both India and U.S.A. Therefore, the value of currency of each country in terms of the other currency depends upon the demand for and supply of their currencies.

(c) In the above diagram, the price on the vertical axis is stated in terms of domestic currency (that is, how many rupees for one US dollar). The horizontal axis measures the quantity demanded or supplied.

(d) In the above diagram, the demand curve [DD] is downward sloping.

This means that less foreign exchange is demanded as the exchange rate increases. This is due to the fact that the rise in price of foreign exchange increases the rupee cost of foreign goods, which make them more expensive

. As a result, imports decline. Thus, the demand for foreign exchange also decreases.

(e) The supply curve [SS] is upward sloping which means that supply of foreign exchange increases as the exchange rate increases.

This makes home country’s goods become cheaper to foreigners since rupee is depreciating in value. The demand for our exports should therefore increase as the exchange rate increases.

The increased demand for our exports translates into greater supply of foreign exchange. Thus, the supply of foreign exchange increases as the exchange rate increases.

2. Disequilibrium conditions under equilibrium exchange rate:

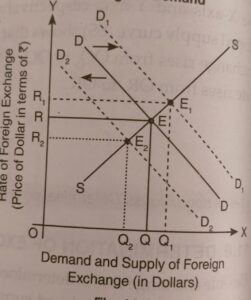

(a)Change in demand:

(i) Increase in demand for dollar: An increase in the demand for US dollar in India will cause the demand curve to shift to D1D1 the exchange rate rises to P1$.

Note that increase in the exchange rate means that more rupees are required to buy one US dollar. When this occurs, Indian rupee is said to be depreciating.

ii) Decrease in demand for dollar: A decrease in the demand for US dollar in India will cause the demand curve to shift to D2D2 and the exchange rate falls to P2$.

Note that decrease in the exchange rate means that less rupees are required to buy one US dollar. When this occurs, Indian rupee is said to be appreciating.

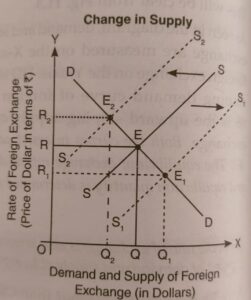

(b) Change in Supply

(i) Increase in supply for dollar: An increase in the supply of US dollar causes the supply curve to shift to S1S1 exchange rate falls to P1$. In this case, rupee cost of US dollar is decreasing and the Indian rupee is said to be appreciating.

Decrease in supply of dollar: A decrease in the supply of US dollar causes the supply curve to shift to S2S2 and exchange rate rises to P2. In this case, rupee cost of US dollar is increasing and the Indian rupee is said to be depreciating.

Types of exchange rate macro economics

1. Fixed exchange rate system (Pegged exchange rate system):

(a) Meaning:

(i) The system of exchange rate in which exchange rate is officially declared and fixed by the government is called fixed exchange rate system.

(ii) When domestic currency is tied to the value of foreign currency, it is known as

pegging.

(iii) To maintain stability in fixed exchange rate system, government buy foreign currency when exchange rate appreciates and sell foreign currency when exchange rate depreciate. This process is called Pegging operation, i.e., all efforts made by the central bank to keep the rate of exchange stable.

(i) Fixed exchange rate is not determined by the forces of demand and supply in the market. Such a rate of exchange has been associated with Gold Standard System during 1880-1914.

(ii) According to this system, value of every currency is determined in terms of gold. Accordingly, ratio between gold value of the two countries was fixed as exchange rate between those currencies.

(iii) For example, Value of one dollar = 10 gms of gold.

Value of a rupee = .125 gms of gold

Then, 1 dollar = 10/.125 = Rs. 80

(b) Merits of fixed exchange rate system:

(i) Stability: It ensures stability, in the international money market/exchange market. Day to day fluctuations are avoided.

It helps formulation of long term economic policies, particularly relating to exports and imports.

(ii) Encourages international trade: Fixed exchange rate system implies low risk and low uncertainty of future payments. It encourages international trade.

(iii) Co-ordination of macro policies: Fixed exchange rate helps co-ordination of macro policies across different countries of the world.

(c) Demerits of fixed exchange rate system:

(i) Huge international reserves: Fixed exchange rate system is often supported with huge international reserves of gold.

(ii) Restricted movement of capital: Fixed exchange rate restricts the movement

of capital across different parts of the world.

(iii) Discourages venture capital: Fixed exchange rate discourages venture capital in the international money market.

(d) Devaluation of currency: Devaluation refers to decrease in the value of domestic

currency in terms of foreign currency by the government. It is a part of fixed

exchange rate.

(e) Revaluation of currency: Revaluation refers to increase in the value of domestic

currency by the central government. It is a part of fixed exchange rate.

2. Flexible exchange rate (floating exchange rate system):

(a) Meaning: The system of exchange rate in which value of a currency is allowed to float freely as determined by demand for and supply of foreign exchange is called flexible exchange rate system.

(ii) Under this system, the central banks, without intervention, allow the exchange rate to adjust to equate the supply and demand for foreign currency.

(iii) The foreign exchange market is busy at all times by changes in the exchange rates.

(b) Merits of flexible exchange rate system:

(i) No need for international reserves: Flexible exchange rate system is not to be supported with international reserves.

(ii) International capital movements: Flexible exchange rate system enhances movement of capital across different countries of the world. This is due to the fact that member countries are no longer required to keep huge international reserves.

(iii) Venture capital: Flexible exchange rate promotes venture capital in foreign exchange market. Trading in international currencies itself becomes an important economic activity.

(c) Demerits of flexible exchange rate system:

(i) Instability: It causes instability in the international money market. Exchange rate tends to fluctuate like price of goods in the commodity market.

(ii) International trade: Instability in foreign exchange market causes instability in the area of international trade. It becomes difficult to draw long period policies of exports and imports.

(iii) Macro policies: While fixed exchange rate helps coordination of macro policies, flexible exchange rate makes it a difficult proposition. Day to day fluctuations in exchange rate makes bilateral trade agreements a difficult exercise.

(d) Currency depreciation:

(i) Currency depreciation refers to decrease in the value of domestic currency in terms of foreign currency. It makes the domestic currency less valuable and more of it is required to buy a foreign currency. It is a part of flexible exchange rate.

(ii) For example, rupee is said to be depreciating if price of $1 rises from 80 to Rs. 90.

(iii) Effect of depreciation of domestic currency on exports: Depreciation of domestic currency means a fall in the price of domestic currency (say, rupee) in terms of a foreign currency (say, $). It means, with the same amount of dollars, more goods can be purchased from India, i.e., exports to USA will increase as they will become relatively cheaper.

(e) Currency appreciation:

(i) Currency appreciation refers to increase in the value of domestic currency in terms of foreign currency. The domestic currency becomes more valuable and less of it is required to buy a-foreign currency. It is a part of flexible exchange rate.

(ii) For example, Indian rupee appreciates when price of $1 falls from Rs. 80 to Rs. 75.

(iii) Effect of appreciation of domestic currency on imports: Appreciation of domestic currency means a rise in the price of domestic currency (say, rupee) in terms of a foreign currency (say, $). Now, one rupee can be exchanged for more $, i.e., with the same amount of money, more goods can be purchased from the USA. It leads to increase in imports from the USA as American goods will become relatively cheaper.

3. Managed floating rate system:

(a) Managed floating exchange rate is a mixture of a flexible exchange rate (the float part) and a fixed exchange rate (the Managed part).

(b) In other words, it refers to a system in which foreign exchange is determined by free market forces (demand and supply forces), which can be influenced by the intervention of the central bank in foreign exchange market.

Kinds Of Foreign Exchange Rate (Spot And Forward Market)

1. Spot market for foreign exchange: spot rate of exchange refers to the rate at which foreign currency is available on the spot.

2. Forward market for foreign exchange: forward rate is the rate at which a future contract for foreign currency is bought and sold.

Crawling peg system: It allows “small” but regular adjustments in the exchange rate for different currencies. Not more than (+) 1% adjustment is allowed at a time. Indeed, it is a small adjustment. But it can crawl, i.e., it can be repeated at regular intervals.

Some Important Terms

1. Nominal exchange rate (NER): The number of units of domestic currency required to purchase a unit of foreign currency is called nominal exchange rate. Thus, $1 = Rs. 80. It may move to $1 = Rs. 95, and so on.

2. Nominal effective exchange rate (NEER):

(a) The concept is useful for an aggregative analysis. A nation has to deal with a number of countries, and hence a number of currencies.

we prepare a basket of all the currencies which we are interested in, and find out the average of the changes in these currencies in a given period. This gives us the nominal effective exchange rate (NEER).

NEER is the measure of average relative strength of a given currency with respect to other currencies without eliminating the effect of change in price.

3. Real exchange rate (RER): RER is the exchange rate which is calculated after eliminating the effects of price change. Therefore, RER is based on constant prices.

4. Real effective exchange rate (REER): REER is the measure of average relative strength of a given currency with respect to other currencies after eliminating the effects of price change.

5. Parity value: parity value refers to the value of one currency in terms of the other for a given basket of goods and services.

If a U.S. dollar buys 50 times the goods and services in India, compared to a rupee, the parity value of a US dollar should be 50 : 1.