Money Credit Sectors and Globalization in India

Money credit sectors and Globalization in India comprise of 3 Chapter of Class 10 Covering the complete syllabus of the chapters i) Money and Credit ii) Sectors of the Indian Economy iii) Globalization in India

MONEY AND CREDIT

When goods are directly exchanged for goods and there is no use of money this system is called Bater System.

Money is something which act as a medium of exchange in transaction It eliminate the problem of double coincidence of wants in which both the parties are buyer and seller one party should have the thing which the other require and vice versa

MODERN TYPE OF MONEY

a. Net banking ,mobile banking

b. Paper notes

c. UPI

d cheque

e. Credit or Debit cards

Function of RBI

It issue the currency

It monitor the work of banks

It provide direction regarding terms and interest

Provides feedback regarding Monetary

Policies of India

It hold a part of cash of all banks in form of cash reserve ratio is 15percent.

Credit:

Some time credit work as an asset to the producer. Let us suppose there is a producer who gets order in bulk during festive season for completing the order he has to hire extra workers, require more raw material from suppliers he takes the raw material from the supplier and promise to pay later.

Then he takes advance from the trader. As his production finishes, he delivers the order making handsome profit after deducting the money he borrowed from the trader and suppliers.

Credit creates debt trap:

Sometime credit creates the debt trap. Let us suppose a small shop keeper takes loan from the lender to meet his day-to-day expenses with the hope he would return later but unfortunately, he got ill could not open the shop for long time the goods in his shop were destroyed so he failed to pay his debt, interest with loan amount grew into large sum so became poorer and his economic condition worsen.

Collateral is an asset that the borrower owns such as land, gold etc. uses as the guarantee to lender until the loan is repaid.

Terms and Condition of loan

Rate of interest

Collateral

Documentation required at the time of taking loan

Mode of payments

Self Help Group.:

It is for poor class people to provide financial resources organised by poor women At this woman of poor class discusses about social problems, they provide loans to needy members at reasonable rate of interest without collateral that all is done by collection of saving from members.

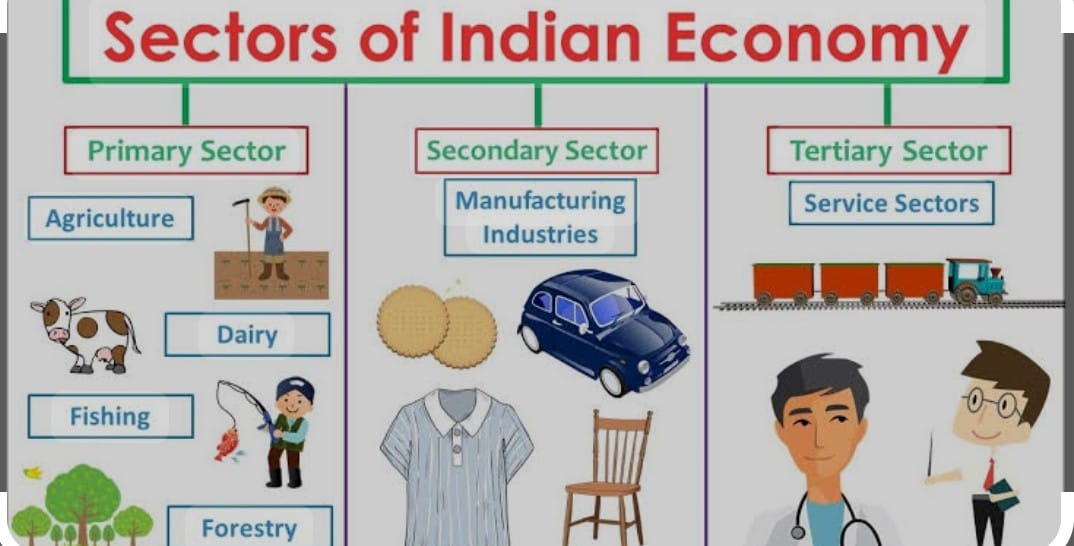

SECTORS OF INDIAN ECONOMY

Indian economy is divided in various sectors.

Primary Sectors in this sector production of goods by exploring the natural resources such as farming, dairy, fishing, forestry etc.

Secondary Sectors this sector cover the activities in which natural products are changed into other forms through the ways of manufacturing that is related to industrial activities such as cotton fiber from cotton balls of plants, making iron and steel from iron ore.

Tertiary Sector the activities do not make production but help in the process of production. This sector is also called service sector which include banking, insurance, transport service etc.

Private Sectors, has its own importance. This sector is run by individuals as well as companies.

Public Sector in this organisation that are owned and operated by government exist to provide services for the citizens of the country.

Organized Sectors are those sectors where the employment terms are fixed and regular, the employees get fix i

American Dollar is used as medium of exchange at international market

Muhammad Yunus was the person to establish Grameen Bank in Bangladesh

Formal Sectors:

Banks and Co-operatives comes in the category the rate of interest is low, collateral is must for getting loan all the system is supervised by RBI and more documents are required and lots of formalities are present.

Informal Sector includes money lenders, traders, friends etc. in this the person who takes loan has to give higher rate of interest, the loan can be given without collateral, no government organisation supervises them, so very less formalities and documents are required. Mostly borrower goes into debt trap and the economic condition worsen day by day.

Farmers get into debt trap because of failure of crops, lowering the price of crops, higher rate of interest changes his economic condition from bad to worse.

GLOBALISATION is the process of rapid integration among the countries. It is the movement of goods and services, production across the countries along with the movement of investment and technology for the production across the countries.

CONDITION BEFORE GLOBALISATION

During the middle of 20th century, the production was organised within the country, only raw material, food stuffs and some finished goods were traded which own or. control the production in more than one nation.

PRESENT CONDITION OF GLOBALISATION

Multinational companies have emerged such that trade was the main channel connecting the countries and they can set up offices and factories the area where there is cheap labour and resources.

MNCs AND WORLD

MNC always set up the production unit near the market, availability of skill and unskilled labours at low, policy of the government of the country is favorable with respect to production unit. They money invested is called foreign investment. Some time they make production with local companies providing them latest technology with additional investment, gradually they buy local companies to increase and expand the production by giving orders to them such as ready garments, footwear,sports item etc.

FOREIGN TRADE AND MARKET INTEGRATION

Foreign trade opens the way for the producer to sell their product across the country they get wider scope for their product. Goods can be imported so the consumer can have more choice to fulfill their requirement. Producers across the country become the close competitors against each other with respect to quality and prices.

AIM OF GLOBALISATION

The aim of globalisation is to liberalise the international trade This was first started by developed countries which set up the rules of international trade also forced the developing countries to remove the trade barriers on the other hand developed countries have unfairly retained the trade barriers this show misuse of their power and dominance.

EFFECTS OF GLOBALISATION

Globalisation has affected to both consumers as well as producers. Frist to consumer gets chance to have improved quality goods with lower prices and variety of choices due to which consumers standard of living became higher.

Right of consumers have been strengthened such Right to information Right to choose, Right to seek Redressal etc. Secondly Jobs have been created. Thirdly local companies have become prosperous by supplying raw material to MNCs Fourthly Top Indian companies have been benefited by increasing competition Fifthly some of the companies of India have become MNCs such as Tata Motors,Infosys,Ranbaxy,Asian Paints etc.

Struggle against globalisation: It is very important to attain fair globalisation which would create equal opportunities for all. The government should protect the interests of all the people of the country and ensure proper labour law be implemented and worker must their rights It should negotiate at the WTO for fairer rules It can also align with other developing countries.

FOREIGN INVESTMENT AND LIBERALISATION

In this process which started in1991 the barriers on foreign trade and foreign investment were removed to large extent. It allowed the foreign companies to set up factories and offices on our soil with more than 51percent stake further import and export of goods was made easier. Moreover, the foreign companies are exempted to pay taxes in early 5 years.

MNC is an enterprise operating in several countries but engaged from one country or group that drives quarter of their revenue from operation in foreign soil.

LIBERALISATION is the reduction or elimination of government restrictions on private trade and business.

EFFECTS of LIBERALISATION are the competition would improve the performance of the producers, goods can be imported and exported easily, Foreign companies could set up the factories and offices to boost the production that allows to take decision freely. The quality of produce would improve.

SEZ. is a special economic zone it is subjected to separate area that have different regulation in the same country with reference to business and conductive to FDI.

WTO is the world trade organisation is the global institution which encourage the world trade.

Aims :

a)Liberalising the international trade allowing free trade for all.

b) Creating uniform and non-discriminatory manner in the international trade among the countries.

c) It wanted to remove all kinds of restrictions in import and export trade.

Main Drawback of WTO

WTO is mainly controlled by developed countries and used in fields that are not directly to trade.

Trade barriers used by government are to increase, decrease or regulate the trade, It decides which kind and how much quantity of specific goods be imported and finally protect the interest the producers within the country.

Factors that have stimulated globalization are the development of information technology-,telecommunication computers and advance internet services.

Read More : Resources and Development

Follow us on :Facebook

Follow us on : Instagram